Investing in Casino Stocks

The casino industry is changing fast. Online gaming is becoming legal in many U.S. states. Macau is the largest gambling market in the world. The island will be reopening in 2022. Casino stocks are considered consumer discretionary stocks. They operate like hotels, relying on room occupancy and conventions for revenue. Spending on gambling and tourism is correlated with the overall health of the economy.

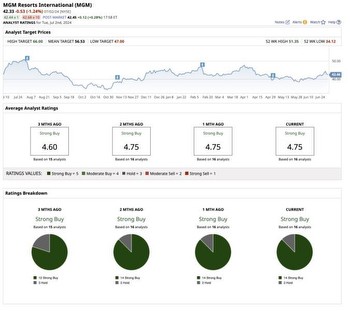

MGM Resorts has one of the most impressive collections of properties in the casino industry. It owns many casino resorts on the Las Vegas strip, as well as locations in Atlantic City, Detroit, and Mississippi. About two-thirds of its 45,000 guest rooms are on Las Las. The stock plunged when the pandemic struck in March 2020, but it has since rallied to post-financial crisis highs.

Las Vegas Sands is focused on the Asian market with five casinos in Macau and Marina Bay Sands in Singapore. It sold its Las Vegas business, including the Venetian, to a private equity firm in March 2021 for $6.25 billion. The strategy of focusing on Asia has backfired during the pandemic, as traffic to Macao plunged.

Wynn Resorts owns the Wynn Palace and WynN Macau in Macao, the Encore in Las Vegas and the Boston Harbor. Wyn n Interactive is a venture it launched in October 2020 with BetBull. It is operating at a loss but it is focusing on developing big luxury properties.

Penn National Gaming owns 44 properties in 20 states. It has a 36% stake in Barstool Sports and formed a strategic partnership with BarStool to promote its own sportsbooks. The company followed up the Bar stool deal by acquiring theScore.

DraftKings went public in 2020. It has a duopoly in online sports betting with FanDuel. DraftKings bought Golden Nugget Online Gaming in August 2021 for $1.5 billion. Its revenue almost doubled in the last year to $614. 5 million.

Caesars Entertainment was acquired by Eldorado Resorts in 2020. Eldorsh has delivered returns of roughly 1,700% since its 2014 IPO. Caesar's operates casinos in 16 states and a sportsbook. It spent $4 billion to buy British online gaming company William Hill Group in April 2021.

As a sector, casino stocks have underperformed the market over the past 10 years. Caesars and online gaming stocks such as DraftKings and Penn National have been big winners. Online gambling in the U.S. is expanding. Post-pandemic reopening could bring a surge in traffic to brick-and-mortar casinos.