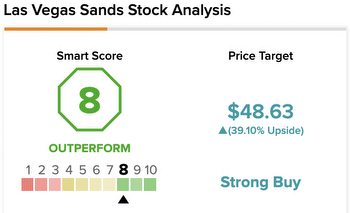

Will Las Vegas Sands Stock Climb The Ladder Again?

Las Vegas Sands and Penn National Gaming have seen a contraction in share prices. Trefis believes Las Vegas is a better bet than Penn. TreFis compares the two companies based on historical revenue growth, returns, and valuation multiple. Las Las Sands is better than Pennsylvania National in terms of return forecast of 223%.

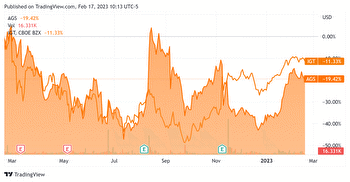

Penn National's revenues grew at an average rate of 20% per year from $3 billion in 2016 to $5.3billion in 2019. Las Vegas Sands' revenues increased at 7% annually from $11.2 billion to $13.7 billion. The company's Macau business was experiencing strong growth before the pandemic. It is now focusing on high-growth regions in Asia. The proposed changes in Macao’s gaming law and the modalities of casino license extension are likely to affect the operations and capital return policies of all concessionaires.

Penn National's key services contribute 84%, 5%, 4%, 7%, and 7% of total revenues. The company's topline expansion has been fueled by multiple acquisitions. Online sports betting and iGaming businesses reported strong growth numbers. The proposed changes in Macau’s gaming law and the modalities of casino license extension are suspected to affect the operations and capital return policies of all concessionaires.

Before the pandemic, Las Vegas Sands reported a much higher operating profit margin and net margin than Penn National Gaming. The company's high net income margin was key to regular dividend payouts and stock repurchases before the Pandemic. In 2021, Sands had $4.2 billion of net revenues and $243 million of operating cash burn. Penn reported $5.9 billion in revenues, $896 million in operating profits and a 15% operating free cash flow margin.

Sands reported $4.2 billion of net revenues and $243 million of operating cash burn in 2021. Penn National reported revenues of $5.9 billion and operating profits of 15%. The company used $1.1 billion in operating free cash flow for property, plant and equipment and acquisitions.

Sands has higher financial leverage than Penn National Gaming. In 2019, Sands reported $12 billion in revenues, nearly thrice of Penn. National's $5.3 billion long-term debt obligations could be a drag on shareholder returns if growth metrics stall. Sands’ high margins will generate more cash than the comparable amount at Penn, but it's better to buy a more balanced portfolio.

Sands reported $12 billion in revenues in 2019. Its operating cash burn has been $1.4 billion the last two years. Penn National's long-term debt obligations could be a drag on shareholder returns if growth metrics stall.