Wynn Resorts Will Unleash Online Gaming Into a Public Company

Wynn Resorts is the latest casino company to signal the future gambling capital of the world isn’t Macau or Las Vegas — it’s your laptop or smartphone.

The gaming company behind multibillion-dollar resorts in Las Vegas, Macau, and Boston this week announced plans to take its Wynn Interactive online gaming platform public via a special purpose acquisition company, or SPAC. Wynn Interactive will merge with the blank-check company Austerlitz Acquisition Corp., with the combined company having a $3.2 billion valuation.

The Wynn deal follows a string of similar online betting platforms going public via SPAC like DraftKings and Golden Nugget Online Gaming Inc. It’s also the latest sign traditional casino operators see online gaming as a leading source of future revenue.

“I’ve really been thinking about online sports betting in the [online gaming] space over the last few years,” Wynn Resorts CEO Matt Maddox said on an investor call this week. “We knew that this is an opportunity that we had to capitalize on.”

Maddox anticipates online gaming and sports betting to be a $45 billion industry within North America by 2030. That’s just shy of the $48 billion in annual revenue casinos and card rooms generated just before the pandemic, according to the 2019-2020 North America Gaming Almanac.

The 300-person Wynn Interactive team is still a small component of the 27,500-employee Wynn Resorts gaming conglomerate. But Maddox said he felt online gaming was on track to be just as large as the company’s commercial casino revenue in roughly the next five years.

“Which, by the way, that’s typically how long it takes to build one of our brick-and-mortar properties,” he added.

Wynn will retain a 58 percent stake in the combined company, and Austerlitz will inject $640 million. It has been a rapid growth story for Wynn Interactive, which only formed late last year following a merger with European online gaming operator BetBull. Wynn Interactive appears to have doubled its employee count since last November.

Rapid Growth

The American online gaming market grew exponentially following the U.S. Supreme Court’s 2018 decision to lift a ban on sports betting in most states, opening up many new markets for gaming companies.

Wynn Interactive currently operates in six states and has access to 15 more. The company expects to eventually reach nearly 80 percent of the U.S. population from the markets where it can operate.

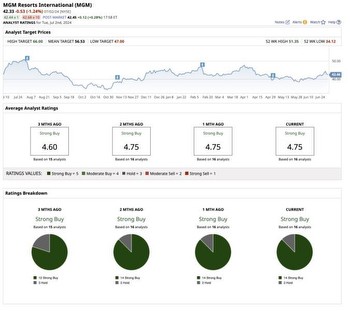

Wynn competitors like MGM Resorts and Caesars Entertainment are all pursuing their own online gaming platform.

Barry Diller’s IAC/InterActive took a $1 billion, or 12 percent, stake of MGM Resorts last year with the intention of beefing up its online gaming presence. Caesars Entertainment closed last month on its roughly $4 billion acquisition of UK-based gaming platform William Hill, which accelerated its own presence in the sector.

“We’re going to invest to ensure that we’re winners in this space,” Maddox said of Wynn’s growth. “It felt like the exact right thing to do, and we’re very excited to have $640 million of committed capital injected into this company to launch this venture.”

The Future of Casino Resorts

If the future of gambling is online, that might have some questioning the future of the thousands of hotel rooms accompanying casinos in major markets like Las Vegas and Macau.

Casino operators aren’t abandoning hotels so much as they’re adding a new way to reach customers. Occupancy rates at Wynn’s Macau resorts averaged 93 percent during the Golden Week holiday earlier this month, and weekend occupancy rates in Las Vegas are in the 90-percent range, Maddox said.

But there are only so many people who can fly to Las Vegas or Macau, even in a non-pandemic travel environment. It’s also a way of generating gambling revenue from customers after they return home.

“Once engaged, we know omni-channel customers have vastly more value to our company than single-channel customers,” MGM Resorts CEO Bill Hornbuckle said on a February investor call.