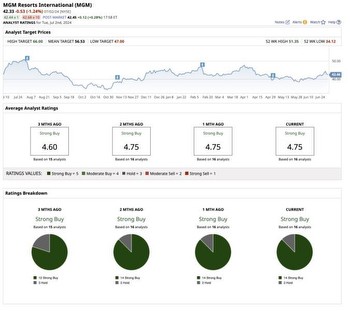

Analyst Cuts Price Targets For Wynn, Las Vegas Sands As Macau Gaming Recovery Lags

Gambling stocks have been a mixed bag for investors in 2021. There are uneven trends in U.S. casino gambling, online sports betting and iGaming. Macau, China market is sluggish.

Bank of America analyst Shaun Kelley reiterated his Buy rating for Wynn Resorts, Limited (NASDAQ:WYNN) but cut his price target from $145 to $130. Kelley also reiterated the Neutral rating on Las Vegas Sands Corp. (NYSE:LVS) and cut the price from $67 to

Kelley believes there are at least five bullish catalysts driving a better-than-expected recovery in U.S. gaming. They are: Strong consumer spending trends, Pent-up entertainment demand, the return of older gamblers, and a recovery of air travel. Regional U.,S., casino gross gaming revenue was up 9% from 2019 levels in the month of June. May Las Vegas Strip GGR was also up 27%. Macau is the major laggard in gambling industry, because of a COVID-19 outbreak in Guangdong in May.

Analyst cuts price targets for Wynn and Las Vegas Sands. Strong consumer spending trends, entertainment demand and the return of older gamblers are reasons.

Analyst cuts price targets for Wynn, Las Vegas Sands and Churchill Downs. Bank of America's six Buy-rated names in the gaming space are WynN Resorts, Boyd Gaming Corporation, Churchill Down's, Penn National Gaming, Inc and Vici Properties.

Analyst cuts price targets for Wynn Resorts, Boyd Gaming Corporation, Churchill Downs, Inc. and Penn National Gaming, which is also down.

For now, casino stock investors will be watching the U.S. markets to see if the booming gaming industry is merely a temporary phenomenon due to stimulus and pent-up demand or whether the market can maintain its recent momentum. In Macau, investors are watching to find out how long it may take the industry to return to pre-pandemic levels.