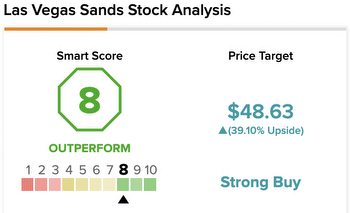

Will Tides Turn For Las Vegas Sands Stock?

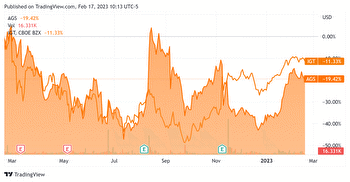

Since March, shares of Las Vegas Sands and Penn National Gaming have declined. Las Las Sands has higher profitability and a lower market capitalization. Penn stock reached historical highs in March as investors speculated on market share gains of its sports betting application, Barstool. Trefis created an interactive dashboard analysis to compare the two stocks.

Before the pandemic, Penn National's revenue grew at an average rate of 20% per year. Las Vegas Sands' revenues grew 7% a year from $11.2 billion in 2016 to $13.7 billion by 2019. The proposed changes in Macau's gaming law are likely to affect the operations and capital return policies of all concessionaires. Sands is likely to observe a headwind as its long-term growth plans focus on Asia and particularly Macao.

Penn National's key services contribute 81%, 10%, 6%, 1%, 3%, and 3% of total revenues. The company's gaming business observed strong growth in recent years driven by multiple acquisitions. Before the pandemic, Sands’ Macau, Vegas, and Singapore properties accounted for 63%, 15%, 22% and 22%. The proposed changes in Macao”s gaming law are suspected to affect the operations and capital return policies of all concessionaires.

Sands has a well-established capital return policy. In 2019, Sands reported $13.7 billion of net revenues and $3 billion in operating cash flow. Penn National reported revenues of $2.3B and operating profit margin of 30%.

Sands has a well-established capital return policy. The company returned $3 billion as dividends to shareholders and managed $1 billion of capital expenses from property sales in 2019. Penn National reported $2.3billion of revenues and $704 million of operating cash flow at an operating Cash Flow Margin of 30%.

Sands has a higher financial leverage than Penn National Gaming. Penn has $11 billion of long-term debt, $3 billion in equity and $16 billion worth of assets. Sands has less cash burn than the other two companies. The high margins of Sands' properties will generate more cash than those of Penn.

Sands' operating cash burn was $1.3 billion in 2020. Penn National Gaming reported a $623 million impairment charge in the same year. Sands has $13 billion revenues and Penn has only $5. 3 billion.