5 Best Casino/Gaming Stocks To Buy Now

Casino stocks are classified as consumer discretionary companies because of the positive relationship between gaming, tourist expenditure, and GDP growth.

Many states in the US are moving to legalize internet gambling, and established casinos and startups are racing to cash in. The Asian gambling market focused on the Chinese province of Macau, has established itself as the biggest in the world, yielding enormous profits for the few companies that have been granted licenses to operate there.

The gaming sector took a significant blow from the COVID-19 epidemic. Still, with the possibility of a complete reopening in 2022, businesses like those in Las Vegas might see an increase in revenue.

Here are the five most alluring gambling stocks on the market now if you’re interested in investing in the casino industry.

Golden Entertainment, Inc.

The gaming activities of Golden Entertainment, a diversified gaming corporation, are included in its portfolio alongside those of casinos and distributed gaming. It owns and manages casinos, taverns, and gaming terminals in various public establishments. At the beginning of May, the firm released its financial results for the first quarter of its fiscal year 2022 (FY), which covered the three months ending on March 31, 2022.

Profit increased by 239.6% on a 14.2% increase in sales (YOY). Net income for Golden Entertainment was up over the same period a year earlier because of decreased non-operating expenditures and a more significant income tax gain.

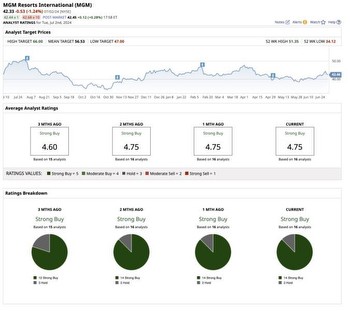

MGM Resorts International

Regarding casino resorts, MGM boasts one of the most remarkable portfolios. The Bellagio, MGM Grand, The Mirage, Luxor, and New York-New York are just a few of the well-known properties under its ownership. The company also operates casinos in Atlantic City, Detroit, and Mississippi. Additionally, it owns 56 percent of the casino operations at MGM Macau and MGM Cotai in Macau.

About two-thirds of its 45,000 guest rooms are on the strip, making it more susceptible to Las Vegas tourism than many of its counterparts.

With investment from IAC/Interactive (NASDAQ: IAC) and a switch to online gambling with BetMGM, MGM’s stock has risen to post-financial-crisis highs after plunging after the pandemic first hit in March 2020. In 2021, it introduced internet betting in numerous states and operated sportsbooks at some venues. As a result, we are gaining pace for the post-pandemic period, with adjusted EBITDA exceeding its levels before the pandemic as of the third quarter of 2021.

Hilton Grand Vacations Inc.

As a worldwide leader in the timeshare industry, Hilton Grand Vacations is a household name. The firm constructs and manages a chain of high-end resorts for holiday ownership in popular travel locations, including Las Vegas and other entertainment hotspots.

From a net loss of $7 million in the same period last year, Hilton Grand Vacations has turned a profit of $51 million. In addition, overall income increased by a whopping 231.5% year over year.

DraftKings

In 2020, pure-play online gambling business DraftKings went public through a SPAC and were included here. Together with FanDuel, it forms a duopoly in the burgeoning market for online sports betting. As of the third quarter of 2021, DraftKings has a 29% market share in the three leading states for online sports betting (New Jersey, Pennsylvania, and Michigan), while FanDuel had a 40% share.

DraftKings has grown by acquisition, as have many of its competitors. For example, to broaden its customer base outside sports betting and daily fantasy sports, the company invested $1.5 billion in acquiring Golden Nugget Online Gaming in August 2021.

DraftKings’ income almost quadrupled to $614.5 million in 2020 due to the pandemic’s isolationist and stay-at-home directives. The company has excellent momentum, with projections projecting sales doubling again in 2021 and close to 50% top-line growth in 2022.

In the third quarter of 2021, the firm hit 1.3 million paying customers. So while it is currently deeply in the red, DraftKings has almost unrivaled expansion potential in the gambling sector.

Playa Hotels & Resorts

The Netherlands-based Playa Hotels & Resorts owns, manages, and constructs all-inclusive hotels and resorts throughout Mexico and the Caribbean. You may stay there and enjoy the many forms of entertainment, food, and hotel. The firm released its Q1 FY 2022 (ending March 31, 2022) financial data early in May.

Compared to a net loss of $69.7 million in the same period a year earlier, Playa Hotels & Resorts posted a net gain of $42.7 million. In addition, the year-over-year revenue growth rate was 182.4 percent.