PENN: 2 Casino Stocks Wall Street Loves

The ongoing U.S. mass vaccination drive bodes well for the tourism industry because the pent-up demand for travel is through the roof. With most travel and hospitality companies receiving huge, advanced bookings, brick-and-mortar casinos and related business segments are likely to soon see increasing foot traffic. This is why the casino management systems market is expected to grow at a 16.4% CAGR over the next five years to hit $13.7 Billion by 2025.

Furthermore, online gambling has gained in popularity since the onset of the pandemic as an alternative to brick-and-mortar casinos. This is evidenced by the VanEck Vectors Gaming ETF’s (BJK) 81.2% returns versus SPDR S&P 500 ETF’s (SPY) 45.3% over the past year.

Given this backdrop, Wall Street analysts expect casino stocks Penn National Gaming, Inc. (PENN) and Melco Resorts & Entertainment Limited (MLCO) to deliver solid returns in the coming months.

Penn National Gaming, Inc.(PENN)

PENN owns and manages gaming and racing properties, and operates video gaming terminals, with a focus on slot machine entertainment. The company operates through four segments: Northeast, South, West, and Midwest. As of December 31, 2020, the company owned, managed, or had ownership interests in 41 gaming and racing properties in 19 states.

On May 3, PENN established Penn Game Studios, an in-house content development team focused on creating exclusive iCasino content for its customers. To fuel this effort, PENN will be acquiring HitPoint Studios, Inc. and its spun-off real money gaming company, LuckyPoint Inc.

In March, PENN received a temporary permit from the Virginia Lottery to offer online sports betting through its Barstool Sportsbook mobile app in the Commonwealth of Virginia. The company hopes that both the acquisition and approval from Virginia lottery will help it lead as the omni-channel provider of retail and interactive gaming, sports betting and entertainment.

PENN’s total revenues for its fiscal year 2021 first quarter, ended March 31, was $1.27 billion, which represented a 14.2% rise year-over-year. The company’s operating income was $216.50 million, compare560.60 million operating loss. PENN’s net income has improved significantly to $91 million for the quarter, compared to a $608.60 million net loss . Also, its $0.55 EPS compared to a $5.26 loss per share . It had cash and cash equivalents of $2.06 billion as of March 31, 2021.

A $0.40 consensus EPS estimate for the current quarter, ending June 30, represents a 123.7% improvement year-over-year. The $1.22 billion consensus revenue estimate for the current quarter represents a 389.4% gain from the prior-year period. Analysts expect the stock’s EPS to grow at a 141.9% rate per annum over the next five years. The stock has gained 481.1% over the past year to close yesterday’s trading session at $91.41.

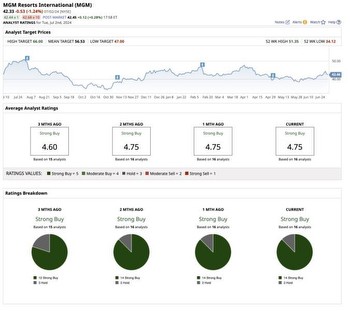

All five Wall Street analysts have rated the stock “Buy.” The analysts expect the stock to hit $150.25 in the near term, which indicates a potential upside of 64.4%.

Melco Resorts & Entertainment Limited(MLCO)

MLCO develops, owns, and operates casino gaming and entertainment resort facilities in Asia and Europe. The company operates through seven segments—Altira Macau, Mocha, City of Dreams, Studio City, City of Dreams Manila, Cyprus Operations, Corporate and Other. It has over three casino-based operations in Macau, namely City of Dreams, Altira Macau and Studio City, and non-casino-based operations in Macau at its Mocha Clubs. It also has a casino-based operation in the Philippines.

Last month, MLCO, along with its entire integrated resort portfolio, achieved the esteemed international third-party responsible gaming accreditation from RG Check. As the first integrated resort operator in Macau and the Philippines, RGC’s support should help MLCO to offer the highest standards of service whilst striving to ensure the provision of a safe and fair gaming experience for the customers.

In January, the company priced an international offering of 5.375% senior notes due 2029. MLCO intends to use the net proceeds from the offering, together with cash on hand if applicable, for the repayment of the principal amount drawn under the revolving credit facility, together with accrued interest and associated costs, and any remaining balance for general corporate purposes.

MLCO’s operating income from its Mocha segment came in at $163,000 for its fiscal year 2021 first quarter, ended March 31, 2021 versus a $1.69 million loss in the prior-year period. MLCO has gained 22.8% over the past year and 12.6% over the past six months.

Analysts expect MLCO’s EPS to be $0.65 for the next fiscal 2022, which represents an 232.7% rise from the prior-year period. It surpassed the Street’s EPS estimates in three of the trailing four quarters. Also, the consensus revenue is estimated to be $688.84 million for the current quarter, ending June 30, representing a 291.7% rise year-over-year.

All three Wall Street analysts have rated the stock “Buy.” Moreover, the analysts expect the stock to hit $25.07 in the near term which indicates a potential upside of 35.2%.

PENN shares were trading at $83.93 per share on Thursday afternoon, down $7.48 (-8.18%). Year-to-date, PENN has declined -2.83%, versus a 12.46% rise in the benchmark S&P 500 index during the same period.