Are These 2 Gambling Stocks Poised for a Comeback?

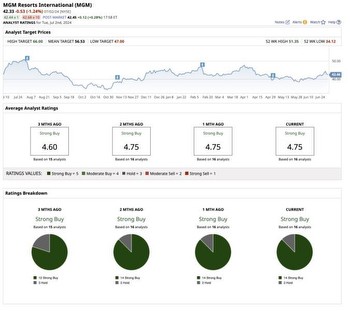

MGM Resorts International and Penn Entertainment are gambling stocks that are worth keeping on your investment watchlist.

MGM Resorts is down 22% this year. The company's industry-leading assets and inflation-resistant business model can help it thrive in this economic environment. Second-quarter results show MGM Resort's net revenue increased 44% to $3.3 billion. Las Vegas Strip sales jumped 113% and the company is bolstering its portfolio with additions like The Cosmopolitan.

Penn Entertainment is down 29% so far in 2022. The company struggles with competition from larger rivals like MGM. However, its reasonable valuation and rapidly growing digital business make it poised for a long-term comeback. Second-quarter revenue grew 5.2% to $1.63 billion, driven by strength in the company's interactive segment. Management plans to add third-party games to its portfolio and create its own casino games.

MGM Resorts and Penn Entertainment operate in the casino and online gambling business. MGM's strong brands and exposure to the Las Vegas strip make it more likely to outperform if the economy remains strong. Penn's diversified footprint in regional casinos across North America can help shield it from a downturn in big gambling hubs or any particular geography.