Betting on a Las Vegas Comeback

One of my favorite places in the world is Las Vegas. The lights, the casinos, the action and just the overall atmosphere make this city an annual destination for me.

However, Las Vegas was shut down for over a year due to COVID-19 restrictions. We couldn’t visit most of the places we love at the height of the pandemic. Even when things opened up a little, it wasn’t very desirable because of rules put in place to fight the virus.

Then the vaccines came and the cases dropped, helping America and Vegas reopen. Tourism started to pick back up all over the country as people started to travel again.

When it comes to Vegas, I can tell you firsthand that the city is back and more energized than ever. I was there just a few weeks ago and from what I saw, the reopening is causing a spectacular bounceback.

I’ll talk about my experience and highlight some stocks that will benefit from the reopening, but let’s first talk about the impact the pandemic had on the city.

Las Vegas and COVID-19

COVID has taken its toll all over the globe, but the metro area that was hit the hardest economically was Las Vegas. When you have a city so dependent on tourism, the suffering was amplified when that aspect of the economy was shut off.

Let’s go over what happened last March in Las Vegas:

March 5th 2020: First case of COVID in Nevada.

March 10th: MGM Resorts closes all buffets at its properties

March 12th: Gov. Steve Sisolak declares state of emergency

March 12th: No March Madness tournament announced

March 12th and 13th: NHL and NBA suspended

March 15th: Wynn Closes (other hotel/casinos follow within a week)

March 24th: Social restrictions ordered, no more than 10 people in a group

April 1: Stay at home order.

Writing that down and reliving that timeline isn’t easy. It was a rough time for all of us. While a lot of us adapted well and could work from home, the reality was that...

Las Vegas was closed!

The U.S. Travel Association said that the pandemic resulted in $500 billion in cumulative losses in Vegas alone, which added over $60 billion in losses to tax revenues. Unemployment spiked to 34% and according to the Bureau of Labor Statistics was the largest of any metro area in the country.

Even when we got past the initial fear stage and things started opening up, the recovery was very slow. Conventions were still not back and hotels that usually charge $400 a night during Consumer Electronics Show week were charging less than $50 during the same week.

Things were very bleak, but as the pandemic came under control, things started to open up. The city announced that on June 1st all restrictions would be lifted and I got to see that the following weekend. Vegas was back!

And it's not just open again, there is an extra element that will be a tailwind. There has been a shift in culture that has changed the opportunity – not just for Vegas, but for casino and gambling businesses around the nation.

Investor Alert: 8 Travel Stocks Poised to Soar

Now is your chance to get in on the first wave of a multi trillion-dollar recovery in the travel industry.

Americans are confident about travelling again, and they’re making up for lost time. Several stocks in this sector have already surged to new record highs – and they’re just getting warmed up.

The potential profits are significant for investors who get ahead of the trend. Zacks' just-released Travel Mega-Boom special report reveals 8 stocks expected to climb the most. The report is only available until midnight Sunday, June 27.

See Zacks favorite travel stocks now >>

The Appetite for Risk

Only Utah and Hawaii have a 100% ban on gambling and more than half the states now allow sports betting. Over the last decade, there has been a dramatic shift in our culture accepting gambling and the aftermath of the pandemic accelerated that movement.

During the lockdowns, we were all stuck at home with nothing to do and for some reason a lot of us decided to trade stocks. Retail trading shot through the roof as people started to follow the insane stock market moves that were happening. People took their stimulus checks and put them to work, creating a thirst for risk. With “stimmys” in hand and money flowing from the Fed, this risk appetite morphed into degeneracy, which was witnessed in “meme” stocks.

This movement eventually transitioned to gambling when sports came back. Companies like DraftKings and Barstool Sports thrived as each state moved to legalize sports betting. As the states have opened, this risk appetite has helped money start to flow into both regional casinos and Vegas as well.

The Reopening

According to the AGA, America’s casinos were already back before we were fully opened, matching their best quarter ever in the first three months of the year. Brick-and-mortar casino games saw a very strong March, with revenues from slots and table games coming in just 1% shy of March 2019 totals. Sports betting saw a new quarterly record as online sports gambling continues to grow.

Nevada recently reported their casino gaming revenues in April, obviously seeing a significant jump year over year. You really have to compare the numbers to 2019 and even then, the $1.04B in revenue was 11% growth. Las Vegas strip revenues saw 0.3% growth over that same two-year period.

And for your absurd year-over-year number, gaming licenses saw a 28,255.93% increase because of the limited amount of activity from 2020.

The casino industry has rebounded as leisure travelers have come back. I was one of them just a couple weeks ago as I celebrated my birthday in Vegas for a weekend. It was 110 degrees outside, so I was surprised to see the Strip bustling with people on the sidewalks. When you went inside, the casino was packed, making it hard to find a spot at the blackjack table. I stayed at the Cosmopolitan, where the sportsbook was slammed for the NBA playoffs.

It was a great sight to see, but Vegas still has challenges ahead. Labor shortages, cancelled conventions and a slower recovery in corporate travel remain obstacles to a full recovery. But with restrictions being fully lifted, we should see improvement in those areas over the summer months.

Finding the Golden Nugget

There are a handful of casino names that focus on Las Vegas, but there are also companies that are more regional and have shifted focus to Macau in China. Let’s take a look at the Las Vegas stocks as well as some other casino names:

BYD - Boyd Gaming operates in ten states and has a $7 billion valuation. The company operates 29 properties and sees about 30% of its revenues from Vegas. The remaining revenue comes from four land-based casinos, six dockside riverboat casinos and four barge-based casinos.

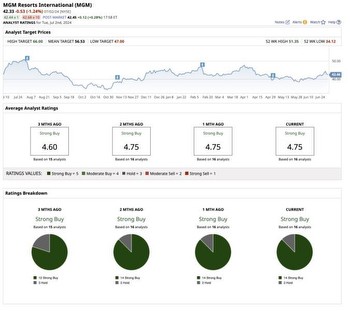

MGM - MGM Resorts owns and operates casino, hotel and entertainment resorts in the U.S. and Macau. The company is worth $19 billion and the stock is up almost 30% on the year. The company owns properties in Macau, Las Vegas and other regional locations. It has recently ventured into the competitive online sports betting market with hot names like Penn National and DraftKings.

CZR - Caesars Entertainment has a $20 billion valuation and is based in Reno. One of the oldest casino names, the company operates 54 domestic properties in 16 states.

WYNN - Wynn Resorts has a $14 billion market cap and operates in Las Vegas, Boston and Macau. Its Vegas segment includes both Wynn Las Vegas and Wynn Encore and accounts for 25% of its revenues. Macau accounts for 60%, while Boston Harbor accounts 15%.

LVS - The biggest name by market cap is Las Vegas Sands, which has a focus in Asia after selling its Vegas properties. The company is valued over $44B and owns and operates big names like The Venetian Macau, The Plaza Macao, Sands Macao and Marina Bay Sands.

How to Capitalize

I plan on going back to Vegas in October to watch my Chicago Bears play in the new stadium the Las Vegas Raiders now call home. I will be very excited to see how Vegas has continued to bounce back and where they will be in four months.

Until then, I will be eyeballing the casino names and looking for entry points in these stocks.

You can bet on the idea that there will be plenty of opportunities in these names going forward, join me and let’s profit from it!

As exciting as these opportunities are, Las Vegas is just one part of a massive recovery in the travel and tourism industry.

Airbnb’s CEO called it a “rebound unlike anything we’ve seen in a century.”

The pandemic wiped out nearly $4.5 trillion dollars from the space globally. Now that people are beginning to feel comfortable traveling again, countless millions are preparing to take their first vacations in two years. Intense pent-up demand is giving investors a chance to target highly lucrative trades.

To help you capitalize on the coming surge, Zacks has just released a brand-new special report called Travel Mega-Boom: 8 Stocks for the Trillion-Dollar Rebound.

It provides analysis of eight segments of the travel industry (including casinos) that are ready to jump higher. It highlights the leading stocks in those segments, and then picks one stock we believe will climb the most from each group. You may be surprised at these recommendations.

I encourage you to check them out right away. But don't delay. The deadline to download Travel Mega-Boom is midnight Sunday, June 27.

See these 8 promising stocks now >>

Good Investing,

Jeremy Mullin

Stocks Strategist

Jeremy Mullin has been a professional trader for more than 15 years with specific expertise in profiting from patterns set by High-Frequency Traders. He is the editor of Zacks Counterstrike.