How gambling affects your taxes

If you win money betting on the Super Bowl this weekend, don't spend it all at once — you'll have to pay taxes on those earnings.

The money you win through gambling — whether that's through gambling sitesor apps, casinos, raffles or fantasy sports leagues — is considered taxable income by the Internal Revenue Service. The fair market value of non-cash prizes is taxed, too.

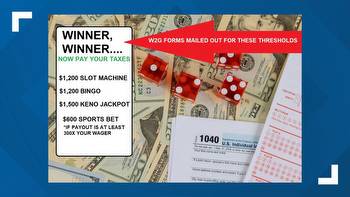

Typically, when you win $600 or more, gambling businesses will send you and the IRS tax forms, commonly a W-2G, but sometimes a 1099-MISC for raffle or sweepstake prizes.

The IRS can use these forms to verify your total income when it processes your tax return. If the winnings are $5,000 or greater, the business that processed your bet might withhold up to 31% of the proceeds for federal income tax, according to the IRS. This will be indicated in Box 4 of your W-2G.

If you didn't receive the forms, you're not off the hook, either. You're still responsible for tracking and reporting all income won through gambling. For that reason, experts recommend keeping a good record of your gambling wins and losses throughout the year.

Fortunately, many gambling and casino sites have a downloadable record of your bets.

Once you have your records together, you'll need to report your winnings as "gambling income" on line 8 of your Form 1040, Schedule 1, which is used to report types of income not listed on the primary 1040 tax form. That total is then added to Form 1040 line 8, under "other income."

Your gambling losses will not be easy to deduct

Your gambling winnings and losses are reported separately in your tax return. The winnings you claim as income include the cost of gambling, or the original wager or bet.

Gambling losses can be deducted, but they can't exceed the winnings you report as income. The cost of your wager can be deducted as a loss as well. However, gambling losses can only be claimed if you itemize your deductions on Schedule A of your Form 1040.

"Let's say you bet $1,000 and you get $3,000 back," says Romeo Razi, a Las Vegas-based certified public accountant. "You're going to report the $3,000 and have a bet loss of $1,000" as an itemized deduction.

However, most people don't itemize their deductions. Instead, they choose the standard deduction, which is a sizable chunk of tax relief totaling $12,950 for single filers in 2022.

For that reason, itemized deductions — including gambling losses — might not be worth the bother since the total amount of those deductions might not exceed what you could claim with the standard deduction.

You risk penalties or jail time for not reporting gambling winnings

If you don't report all of your gambling winnings, you're violating the law. The IRS can discover this by comparing your income with the W-2 forms they receive or by examining your bank deposit activity.

For large sums, you can risk jail time, and for smaller amounts, the IRS can assess additional penalties and interest. A 20% penalty can be appliedif the total underreported amount is either more than $5,000 or 10% of your actual tax liability — whichever is greater.

That said, more casual gambling that doesn't involve W-2 forms, like fantasy football pools between friends, are less likely to be noticed by the IRS.

But even with casual gambling, a large cash deposit or having someone send you money that's described as winnings could still trigger an audit. For that reason, you should report everything.