How Are Gambling Winnings Taxed In Canada?

I think the good news is that Canadian citizens do not have to pay taxes. It is very consumer-friendly for people to participate in lotteries, gambles, and other forms of entertainment without paying any taxes.

Are Online Gambling Winnings Taxable In Canada?

It is not necessary to declare profits from bingo or online casino games. When a Canadian wins money online, he won’t have to pay anything in taxes. Gambling winnings in online casinos are to the Canadian revenue agency? The vast majority of casino winnings are not taxable because they are not considered gambling earnings.

How Much Money Can You Win At A Casino Without Paying Taxes?

if you bet $30 on an ATM machine and turn it around to win $600 on a non-taxed casino. This includes winnings from poker tournaments, keno, and slots.

How Do You Pay Taxes On Gambling Winnings?

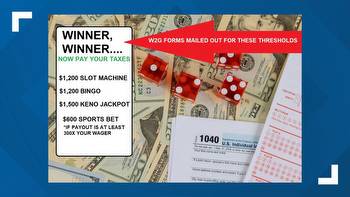

Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040) PDF) should be used to report winnings from other sources, including those that are not reported. In addition to paying taxes on your gambling winnings, it may also be taxable to gain more cash from the game.

How Much Taxes Do You Pay On Gambling Winnings?

Taxes on gambling winnings are generally in the range of 24%. above, for the following sources, including any sweepstakes, lotteries, or wagering pools (this can include funds paid to the players of poker tournaments) the withholding should be applied.

Are Winnings From Gambling Taxable?

Taxes on gambling winnings must be reported on your tax return as the proceeds of your activity are fully taxable. In addition to lottery winnings, raffles, horse races, and casinos generate income from the gambling industry. As in real life, it factors in cash winnings and prize values that are fair market value.

Do You Pay Tax On Online Gambling?

Gambling winnings earned online are completely taxable, regardless of how they were received or whether taxes had already been withheld. Losses from gambling are perhaps eligible for reimbursement. The best way to claim that a gambling loss was accurate is to maintain a record.

Is Online Poker Winnings Taxable In Canada?

The Canada Revenue Agency attempts to collect poker pro taxes. Having taxable earnings is one of the reasons why Canadians benefit from their winnings more than their counterparts elsewhere.

How Much Gambling Winnings Do You Have To Report To Irs?

report all your gambling winnings. Whether you wager a set amount from an office pool, a casino, or in a regular store, all your winnings must be reported as “other income” on your Schedule 1 return. In case you receive a prize that is not cash, such as a car, take into account that it has been evaluated as fair market value.

How Much Tax Do You Pay On Gambling Winnings Nj?

Your winnings will be taxed at a rate of 3% in New Jersey if you play poker there.

Do You Have To Pay Taxes On Online Gambling?

If you win online, all winnings are fully taxable, including those that did not require tax. Losses you incur from gambling may be deductible.

Do You Have To Pay Tax On Gamble Winnings?

It is common for gambling winnings to not be taxable. “Professional” gamblers’ winnings cannot be deducted from their taxable income. A taxpayer who carries on a business when it comes to gambling can’t be presumed to have taxable wins (or losses).