Do Professional Gamblers Pay Tax In Australia?

Professional gamblers are also lucky since their winnings are normally tax-free in Australia in addition to making money on an asing have make money doing something they enjoy; professional gamblers are also lucky as their winnings are generally tax free in Australia.

Do You Have To Pay Tax If You Are A Professional Gambler?

Not only do professional gamblers receive no tax relief on their losses but they can do so regardless of how much they make.

How Much Money Can You Make Gambling Before Paying Taxes?

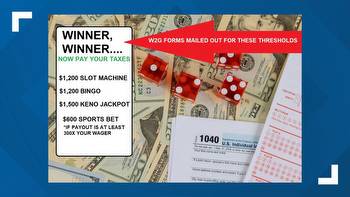

Tax Forms W-2G contain information on the IRS’s ability to report winning documents. Be sure the payer gives you a Form W-2G every time you win: $600 if you have more than 30 times the wager (in which case the payer has the choice to reduce the winnings), $1200 if you have more than one occasion of playing bingo or using a slot machine for your .

Are Gambling Winnings Taxable Ato?

Which method must I use in spensions to the ATO? ? In addition, I’d like to know what percentage of your winnings go towards tax. In the original response, @macfanboy stated that it isn’t necessary to declare your winnings or losses from gambling unless you’re a professional.

Are Professional Gamblers Taxed In Australia?

Gambling in Australia is among the most popular in the world, and the country loses $24 billion a year on a yearly basis. In addition to earning a living through doing something they enjoy, professional gamblers generally earn tax-free winnings because they live off the land.

How Are Professional Gamblers Taxed?

Because gambling winnings are traditional categorised as miscellaneous income, you are not taxed on self-employment income as well. A gambler tax return may, however, subject the gambler to self-employment taxes.

Do Gamblers Have To Pay Tax?

Accordingly, you must pay taxes on your winnings after they have been paid to you. Those who spend their money on gambling, such as lotteries, raffles, horse races, and casinos, account for much of their income. The value of prizes included in the fair market value of a prize is rounded down to cash winnings.

Is A Professional Gambler Self-Employed?

On Schedule C of Form 1040 or 1040-SR, professionals are treated as self-employed individuals who require reporting their income and expenses (but only to the extent of winnings from gaming) only after accounting for expenses. Furthermore, their net income is subject to self-employment taxes.

How Can I Avoid Paying Taxes On Gambling Winnings?

Both winners and losers are present in gambling. Despite winning, even the winners are potential loser if they don’t pay the tax on their bonuses. Taxes on income from your gambling or wagering winnings are calculated as follows, with the fair market value corresponding to the tax you owe. Consequently, you are subject to taxation on the money you receive from casinos.

What Qualifies As A Professional Gambler?

Those who are regarded as professionals are gamblers who win and generate money gambling on various sports, casino games, or poker. It has to include winning more than losing – it doesn’t matter if you’re an experienced gambler and can make money on an occasional basis.

What Expenses Can A Professional Gambler Deduct?

In the event that their gambling business results in a loss, they can take that loss into account when calculating their regular tax deductions. Expenses related to a gambling business are also deductible, including travel and lodging, computer expenses, entry fees/table fees for tournaments, etc.

How Much Can You Make Gambling Without Paying Taxes?

You will receive prizes of up to $1,200 if you play bingo or a slot machine. You have the opportunity to win more than $1500 in profits (reduced by the player’s wager at keno). You can win more than $5,000 from poker tournaments (reduced by the player’s wager). It is mandatory to withhold federal income taxes from earnings of any individual winner.

Do I Have To Pay Taxes On Online Gambling?

Gambling winnings online have full taxable status, which can be reported even on winnings that didn’t require tax withholding. Deductions can be made for gambling losses, if there is one.