Do You Have to Pay Taxes on Gambling Winnings? (Hint: Yes)

Apps and online platforms make it easier than ever to gamble away your money.

Americans gambled with over $54.93 billion in 2022 — a record-breaking amount. That trend gained momentum during the first four months of 2023, when commercial gambling revenue was tracking 13.8% ahead of last year’s pace, according to the American Gaming Association.

Growth has been fueled by online gambling and online sports betting, which make placing a bet as easy as a couple taps on your smartphone. While in-person gambling revenue stayed steady in early 2023, online gambling revenue surged 50.4% year-over-year in April 2023.

Gambling winnings are considered taxable income by the federal government. It doesn’t matter if you won it at the horse track or on DraftKings. Uncle Sam wants his cut.

If you’re placing bets and winning big online, a tax bill might be waiting for you.

Here’s what you need to know about how gambling income is taxed — and why it might be difficult to write-off your losses.

What Gambling Winnings Are Taxed?

All gambling winnings — whether they take place online or in person— are considered taxable income by the Internal Revenue Service.

This includes winnings from:

- Slot machines

- Online sports betting websites

- Fantasy football leagues

- Poker tournaments

- Pool tournaments

- Casino games

- iGaming

- Lottery winnings from scratch-off, pull-tab or machine generated tickets

- Sweepstakes

- Horse or dog races

- Raffles

- Game shows

- Bingo games (in person or at an online casino)

Similarly, the IRS also considers non-cash prizes won from gambling — like a new car — as taxable income.

How to Report Online Gambling Winnings

Gambling winnings are reported on Line 8b of Schedule 1 of the 1040 form. They are taxed at your ordinary federal income tax rate.

When you win $600 or more from an online gambling company, the business will send both you and the IRS a W-2G. You might receive a 1099-MISC for raffle or sweepstake prizes.

You may also receive W-2G if the odds of your winning bet were 300-to-1 or greater. That’s like winning $7,500 on a $25 bet.

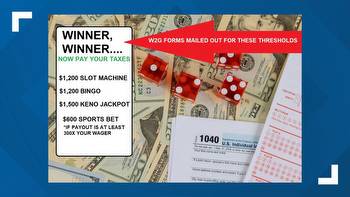

Other forms of gambling have different thresholds before a W-2G is generated:

- $1,200 for bingo and slot machine winnings.

- $1,500 for keno winnings.

- $5,000 for poker tournament winnings.

Even if your winnings don’t exceed those amounts and you don’t receive a W-2G, you’re still technically required to report your winnings to the IRS.

Failing to do so could trigger an audit or result in tax penalties.

Finally, if you won more than the thresholds mentioned above, the payer (the gambling company) may be required to withhold 28% of your proceeds. This amount will be sent to the IRS, but keep in mind, it’s just an estimate. You might get some of it back or owe more when you file your return.

Do States Tax Gambling Winnings?

Most states have a policy of taxing all income earned within their borders, regardless of where you live. So even if you’re not a resident of that state, you may still have to report your gambling winnings there.

The state where you won could even withhold a portion of your winnings to ensure they collect the taxes they’re owed. Your home state should give you a credit for the income taxes you pay to the other state, so you won’t end up paying double taxes.

Remember, tax laws are complex and vary between states, so it’s always a good idea to consult with a tax professional to ensure you’re correctly following the rules.

How to Report Online Gambling Losses

Did you net a lot of losses along with your online gambling income?

Unfortunately, writing off those losses can be tricky. It’s not like deducting stock market or investment losses.

You can only deduct gambling losses if you itemize your annual tax return. Most people — in fact, an estimated 90% of filers — take the standard deduction instead.

In tax year 2023 (for filing in 2024), the standard deduction for single filers is $13,850 and it’s $27,700 for married couples.

That means your gambling losses would need to be above these amounts to make it worthwhile to itemize your return.

Even if you do itemize, the amount of losses you can deduct can’t exceed the amount of gambling income you reported on your return, according to the IRS.

So if you won $1,000 and lost $1,100, then $1,000 of your losses are deductible.

You also can’t carry over gambling losses to the next tax year like you can with stock losses.

You’ll need to keep a detailed record of your wins and losses if you choose to itemize.

Thankfully, many online gambling and casino companies have a downloadable record of your bets, which helps simplify the recordkeeping process.

Pro Tip

Use this interactive IRS tool to determine how to report gambling winnings and/or losses on your tax return.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer at The Penny Hoarder. She focuses on retirement, taxes, investing and life insurance.

Ready to stop worrying about money?