Winner Winner: If You Gambled and Won Last Year, the IRS Needs to Know About It

Gambling winnings can result in a higher tax bill, but there's more to the story.

- If you won money gambling in 2022, you may receive a Form W-2G in the mail.

- Casinos and other gaming establishments are required to issue these forms for wins above a certain amount.

- You might be able to reduce or even eliminate your taxes on gambling winnings using a couple different strategies.

Did you win some money in 2022? Maybe you won a slot machine jackpot, got lucky while betting on a horse race, or won a poker tournament. While it's definitely fun to win money, what happens next often isn't nearly as enjoyable.

Specifically, when you win money from any type of gambling activity, the IRS wants its cut. Gambling winnings are taxable, and you may even receive a tax form in the mail (with a copy sent to the IRS) documenting the win. Here's a rundown of what you need to know about gambling taxes and how you might be able to reduce your tax bill.

The IRS wants a piece of your jackpot

First, the bad news. All gambling winnings are subject to tax and are technically required to be reported. And not only that, but any costs associated with gambling (such as a fee paid to place a wager or the initial bet itself) aren't deductible. In other words, if you win a $1,000 slot machine jackpot on a $5 spin, your taxable winnings are $1,000, not $995.

Having said that, in practice, the IRS doesn't expect you to report every time you win $5 from a scratch-off ticket, but it's important to note that you're officially required to report your winnings. And if you win more than a certain amount, the casino or gaming establishment is required to issue you a Form W-2G.

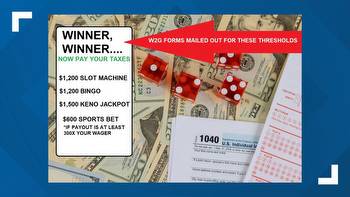

Under current IRS law, the thresholds where you can expect to receive a W-2G are:

- $600 or more on a horse race or 300 times the wager amount, whichever is greater

- $1,200 or more on a slot machine or bingo game

- $1,500 or more at keno

- $5,000 or more in a poker tournament

Casinos don't have to issue W-2Gs for table game wins, with a few exceptions. For example, if you win a progressive jackpot or side bet while playing a table game, you may receive a W-2G. The same $600 minimum or 300 times the wager amount threshold that applies to horse racing technically applies to table games as well, but the latter figure (300 times the wager) generally limits table game tax reporting requirements to jackpots. But the point is that unless you have a single win that is 300 times your wager or more, you won't get a W-2G in the mail just because you cashed out with a few thousand dollars from a blackjack or craps table.

You may be able to reduce your tax burden

First off, you have the option to have money withheld from any large win when the casino attendant gives you a tax form to fill out. The standard federal withholding rate on a W-2G is 24% for U.S. citizens and 30% for non-citizens. This is optional but can help prevent you from owing money unexpectedly at tax time.

Second, if you itemize deductions onyour tax return, you can deduct your gambling losses against your winnings. You can only deduct losses to the extent that you have winnings, so if you have a $1,500 slot jackpot and $2,000 in losses on table games, you can only deduct $1,500 of the losses. But this can effectively wipe out your tax liability.

However, it's important to note the IRS only allows this if you keep records of your losses, and you are likely to raise red flags at the IRS if you, say, try to claim a $20,000 loss to offset a $20,000 jackpot. If you legitimately had the losses and can prove it, you should absolutely do this -- but make sure you can back it up. The good news is that if you use a player's card while playing at a casino, they'll usually do this for you, and you can download your win/loss statements easily.

Gambling winnings are taxable as income, but you might be able to reduce your tax burden by claiming losses. After all, most people don't sit down at a slot machine and win a large jackpot the first time they press the button -- there are usually some losses incurred before that happens. One key takeaway is to always use players cards that track your play when you gamble, as these can help document any losses that can offset a win or find another way to document your wins and losses while playing.

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. for free and apply in just 2 minutes.