Do Professional Gamblers Pay Tax Uk?

Gambling in the UK is generally tax-free. However, those who are professional gamblers are outside tax territory. para 22015 of the HMRC Business Income Manual states this. Gambling and betting, thus, do not necessarily constitute transactions.

Are Professional Gamblers Taxed In Uk?

client wondered if professional gambling was a trade or not and whether its winners had to be taxed on its income. You may be surprised at what we can find out. It doesn’t matter to HMRC how much a professional gambler earns (if he does).

How Much Tax Do Professional Gamblers Pay?

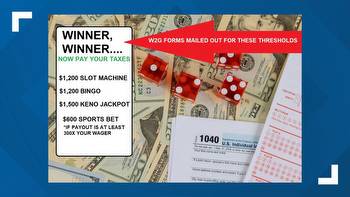

There is usually a flat 24% tax applied to your gambling winnings. Accordingly, winning gambling prizes of more than $5,000 are subject to income tax withholding based on these sources listed below: Any prize pool that includes sweepstakes, lotteries, or wagering pools (like poker tournaments where winners have been compensated).

Do You Have To Declare Gambling Winnings To Hmrc?

The HMRC don’t expect you to declare gambling winnings even if they’re small or large, as you don’t have to pay betting tax on your bets.

How Are Professional Gamblers Taxed?

As an additional benefit, when you win money with a gambling skill, it is regarded as miscellaneous income, which is not subject to self-employment tax. The self-employment tax is not withheld from professional gamblers on their tax returns, however.

Do Professional Poker Players Pay Tax Uk?

In addition, tax benefits are available for the huge lottery winnings. The UK, like any other country, makes excellent business for professional gamblers because of its low tax rates when winning money and no taxation if you even earn your income through gambling.

Do Gamblers Have To Pay Tax?

When a person wins a gambling match, it is taxable and must be reported on his tax return. It includes not only winnings from lotteries, raffles, horse races, or casinos, but also income from other sources. prizes, such as cash winnings and trips for two people.

How Are Taxes Calculated On Gambling Winnings?

If a wager totals more than $5,000, but the winnings are at least 300 times greater than the amount wagered, then the payer must withhold 24% of the winnings for income tax purposes. The amounts due as prize money are withheld according to the specific circumstances of bingo, keno, slots machines and poker rooms.

How Do Sports Bettors Pay Taxes?

Taxable Profits on Cashing Out of Online Sports Sites If you win money betting on sports from sites such as DraftKings, FanDuel, or Bovada, you are also taxable. If your winnings are greater than $600, then the IRS should also be notified.

How Much Money Can You Win Gambling Without Paying Taxes?

When purchasing merchandise at a non-taxed casino, you can take home between $600 and $3,000, except for winnings from poker tournaments, keno, and slot machines which total 300 times the amount wagered.

Do I Need To Declare Gambling Winnings?

Nevertheless, even if you are a professional gambler, your winnings are not taxable no matter what the circumstances are. Therefore, regardless of whether you primarily run a gambling business or simply play bingo, your gambling winnings will not be taxed.

Do You Have To Declare Online Gambling Winnings?

It is the law that you report online winnings as you have in-person to report all winnings received on the Internet, whether they were made in person or online. Some sports betting losses can be deducted if you won’t play the game. So, when claiming gambling losses, keep a accurate record so you will be able to deduct them.

Are Gambling Winnings Taxable Uk?

Due to tax legislation backed up by tax cases such as the recent FTT case, gambling winnings are not currently taxed at the UK level. The profits of casinos and other betting sites are taxed at a 15 percent rate, whereas remote gaming operators are charged a 15 percent rate.