Cryptogambling and taxes: all you need to know about how bitcoin gambling taxes work

Cryptogambling is growing at a fast pace all over the world, including the US. Bitcoin gambling is relatively new and the rules regarding it are still unclear. The most important things you need to understand for getting a clear picture on sports bitcoin gambling taxes are explained below.

Cryptos are treated as digital assets in the US. For tax reasons, cryptos should be treated the same way as stocks and bonds.

Both state and federal laws apply to cryptocurrency gambling taxes.

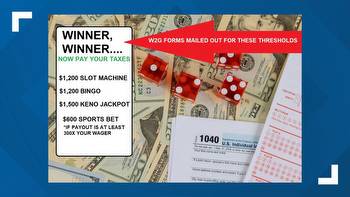

Cryptogambling winnings are taxable events. The Federal gambling winning tax is now 24%. For the time being, we don't get into details about the tax withholding procedure.

Cryptocurrency winnings are treated as capital gains and therefore they are also taxable events. The IRS takes a cut from the profit that you have just made (the capital gain), which is typically 15%. This percentage can range depending on the family composition and the gross income.

Gambling losses can be deducted from the amount of your winnings from gambling within the same taxed period. Gambling loss are offsetting gambling winings, not capital gains.

Gambling winnings should go into your tax return, whether you're a recreational or a professional gambler. For non-professional gamblers, winings are reported as gambling income and losses as itemized deductions. Professional gambers are reporting business income. Bitcoin and cryptocurrencies are treated as assets.