Are Casino Winnings Taxed Uk?

isn’t taxable to the fullest extent in the UK, since most of the world recognizes that. In this country, you won’t need to pay taxes on your winnings or stakes in return for their use. This game exists even if you’ve won £100. Any form of gambling—from bingo to slots to lotteries to horse racing—is subject to this tax.

Do You Get Taxed On Casino Winnings?

You must report to the IRS your winnings from gambling, which are fully taxable. The casino, lotto, raffle, horse race, and charity are all examples of gambling revenue.

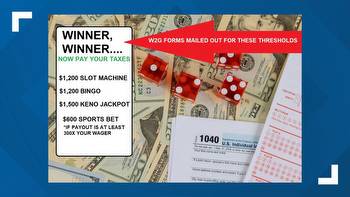

How Much Do Casino Winnings Get Taxed?

You generally pay a flat 24% tax on your gambling winnings. In the following sources, however, winnings exceeding $5,000 are subject to income tax withholding: Any race winnings (such as poker prizes paid to the winners on a daily basis) Lottery winnings (such as those awarded at monthly tournaments) Gaming winnings over $5,000 from any of the above can subject to income

Do You Have To Declare Gambling Winnings To Hmrc?

Gambling winnings do not have to be declared to HMRC if they amount to less than one percent of your daily gross wagers. There isn’t betting tax required whether you win small amounts or lots of money.

How Much Can You Win At A Casino Without Paying Taxes?

can win at a casino without having to pay taxes with non- taxable winnings exceeding $600, except those from poker tournaments, keno, and slot machines, if the total winnings exceed 300 times the number of dollars bet.

What Happens If I Don’T Claim My Casino Winnings On My Taxes?

You may face legal repercussions if you fail to report your casino winnings to your tax authorities. These are the consequences of not claiming their winnings. You may not have to bother if you did nothing below $1,200 because your tax office will not bother if you have won and did nothing below that amount.

Do Casinos Automatically Take Taxes Out Of Winnings?

You normally receive a quarter of your prize money removed from your winnings because the casino is owed IRS tax. In spite of this, you must still pay taxes and report the winnings. Taxes on gambling winnings should be reported to the IRS on any and all winnings.

Do I Need To Declare Gambling Winnings?

It’s still not taxable, even if this is the case with you as a professional gambler. Hence, you won’t be taxed on gambling winnings, no matter how much money you’re making from it or how much fun you’re having.

Do You Have To Declare Online Gambling Winnings?

To report any winnings won via the internet, no matter if the gambling winnings did not have tax implications, you have to report them. The losses from playing games may be deductible. Maintain a record that allows you to claim the winnings from games you win as well as deductions for those you lose.

Are Gambling Winnings Taxable Uk?

Taxation legislation explicitly states that winnings from gambling aren’t taxed in the UK, and the recent FTT case emphasizes this. Those who run remote gaming operations pay a 15 percent duty on their profits instead of casinos and other betting sites.