Strategic Tax Planning for Crypto Gamblers

Not even experienced accounting veterans can tell for sure what the tax implications of cryptocurrency gambling in the U.S. are. They present a complex yet critical challenge, especially with new and evolving Treasury Department regulations, such as Form 1099-DA, designed to aid crypto owners and traders in understanding their tax liabilities.

This article delves into the complexities of crypto gambling taxes and tax planning for crypto gambling within the United States, offering insights and strategies tailored for tax experts and managers.

The IRS hasn’t explicitly defined rules for crypto gambling, but all gambling winnings are taxable. This includes winnings that are generated from cryptocurrencies.

Tax treatment for crypto gambling involves two elements: cryptocurrency transactions and gambling activity. Using cryptocurrencies like Bitcoin for gambling is treated similarly to a stock sale, constituting a realization of capital gains or losses. Here, we differentiate between short-term and long-term capital gains.

If an individual holds the virtual currency for one year or less before selling or exchanging it, then that individual will have a short-term capital gain or loss. Holding the currency for more than one year before selling or exchanging it is indicated as long-term capital gain or loss. For example, buying Bitcoin for $500 and using it for gambling when it’s worth $800 is seen as a taxable gain of $300.

The IRS considers Gambling winnings taxable income, with losses reportable to offset winnings. These are calculated in “sessions”. Here’s how a tax accountant, Michael Feuerstein, described the notion of gambling sessions in an interview for the crypto-gambling portal CasinosBlockchain:

“What is a session? The concept of a session was created decades ago, based on taxpayers physically going to a casino, sports book, or race track and placing their bets. The taxpayer would stay there for some time, creating a “session,” during which all their win and loss bets are netted together. The net result will be either net gambling winnings or losses. Your win and loss sessions are totalled up and reported on two separate sections of your tax return.”

Reporting requirements are clearly outlined — crypto transactions are detailed on Schedule D of Form 1040, while gambling income is reported on Schedule 1, Line 8. Gambling losses are itemized on Schedule A. State-specific income tax rules vary, affecting the net winnings.

The IRS allows the deduction of gambling losses, but only to the extent of reported gambling winnings. Taxpayers can deduct losses from their gambling activities, but the total amount deducted cannot exceed the amount of gambling income reported on the tax return.

Further misconceptions are related to tax credits. These credits directly reduce the tax you owe or increase your tax refund. Some credits may even provide a refund if you don’t owe any tax. The credits generally aim to encourage certain behaviours or support specific demographics, such as education or childcare, which do not align with gambling activities.

Therefore, crypto gamblers should focus primarily on understanding and utilizing the deductions available to them for their gambling activities, as outlined by IRS guidelines.

For U.S. taxpayers, the global reach of cryptocurrency does not exempt them from tax obligations. This fact means that U.S. residents or citizens engaging in foreign crypto gambling, as well as crypto mining, staking rewards, AirDrops, or anything related to crypto gains, must report these transactions on their U.S. tax returns even though these platforms are not subject to local tax laws.

The U.S. has tax treaties with several foreign countries that can affect international income taxation. These treaties typically provide reduced tax rates or exemptions for residents of foreign countries on certain types of income from U.S. sources.

At the same time, U.S. residents or citizens can also benefit from reduced rates or exemptions on income from foreign sources under these treaties. However, most treaties contain a “saving clause” that prevents U.S. citizens or residents from using the treaty to avoid taxation on U.S. source income.

Failure to abide by these rules and report crypto gambling income violates tax laws and may lead to tax audits and legal ramifications.

Keeping precise documentation of crypto gambling wins is essential for accurate tax reporting and reducing the risk of IRS audits. A comprehensive gambling diary, noting the date, type of wager, location, people present, and amounts won or lost, is paramount in simplifying tax preparation and verification.

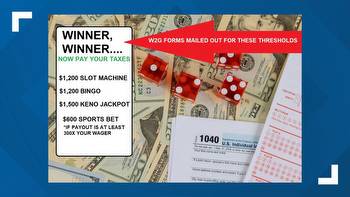

In those instances where Form W-2G is issued, it must be used for reporting. It’s critical to aggregate transactions across multiple platforms and wallets, particularly for crypto gambling, where transactions are decentralized and complex.

Tools like ZenLedger can assist in this process by automating the aggregation and calculation of capital gains or losses, ensuring compliance with IRS regulations.

Additionally, all gambling winnings should be reported on Form 1040 or Form 1040-SR, with losses itemized on Schedule A. Additional reporting forms like FBAR or Form 8938 may be required for offshore gambling.

Key crypto gambling strategies include distinguishing between short-term and long-term capital gains for cryptocurrency transactions, accurately reporting gambling winnings and losses in designated “sessions,” and leveraging allowable deductions to offset reported gambling income.

International considerations are also crucial. The most efficient way to aggregate transactions and maintain comprehensive records is by using different tools that can significantly aid in accurate reporting, minimize tax liability, and reduce audit risk. This strategic approach is essential for navigating the complex tax landscape of crypto gambling.