Is Crypto Gambling Tax-Free?

Crypto gambling has become popular in recent years, with several individuals turning to it as entertainment and earning a potential profit. Crypto gambling is legal in Canada as long as the casino is based offshore and properly licensed. Canada does not have specific laws prohibiting crypto gambling, as most gambling laws were written before cryptocurrencies existed. Provinces in Canada regulate online gambling, and they generally permit the use of cryptocurrencies as a payment method at licensed online casinos.

With the rise of cryptocurrencies and online gambling platforms incorporating them as payment methods, there has been confusion regarding the tax implications in Canada. Typically, traditional casino winnings are not taxable, but does that apply to crypto gambling winning? This article examines the tax implications of gambling with cryptocurrency and whether buying cryptocurrency for gambling is taxable.

Is Crypto Gambling Winnings Taxable in Canada?

The Canada Revenue Agency (CRA) considers crypto gambling winnings as taxable income. Depending on the circumstances, income earned from crypto gambling as either a business income or capital gain must be reported on your tax returns. There is an important difference in how the CRA crypto gambling wins and how it should be reported on your tax returns.

- Business Income: If the CRA deems your gambling activities to be a business, all of the profits (100%) are taxable. The CRA will look at the nature and frequency of your gambling activities, such as the frequency of transactions, whether the intent of your activities is commercial or an investment, and whether the taxpayer is carrying on the activity in a “business-like manner” to determine whether it is a business or investment.

- Capital Gains: If the CRA treats your crypto gambling as an investment/capital gains activity, only half (50%) of the gains will be taxable. If you gamble at a Bitcoin casino, you must keep detailed records of your transactions, including the cost basis and fair market value of the cryptocurrencies, to correctly calculate and report your taxes.

However, the CRA does not provide definitive criteria for making this determination. The CRA refers to general guidance in Interpretation Bulletin IT-479R on securities transactions, which could help determine whether crypto transactions are on account of business income or capital gains. However, this guidance does not specify crypto gambling but instead discusses the CRA’s interpretation of income gains, losses, and tax reporting.

The CRA has stated that it is working with crypto exchanges to obtain customer information to ensure Canadians properly report their crypto-related income and gains. In contrast, traditional gambling winnings in Canada are generally not taxable, except for professional gamblers. However, the CRA does not consider crypto gambling to be the same as traditional gambling for tax purposes.

Tax Differences Between Fiat Gambling vs. Crypto Gambling

There are key tax differences between normal gambling and crypto gambling as viewed by the CRA:

Gambling Winnings

Gambling winnings from a traditional casino such as those from cash casinos, sports betting, and the lottery, are generally not taxable for recreational gamblers in Canada. The biggest difference with regards to the winnings being taxable is that the CRA does not consider cryptocurrencies to be legal tender or currency but rather commodities or investment. Any financial gains or losses from crypto transactions, including crypto gambling winnings, must be reported for tax purposes.

Capital Gains

For traditional gambling, winnings are not subject to capital gains tax, as they are treated as tax-free windfalls. For crypto gambling, on the other hand, any increase in value when converting the crypto winnings to fiat currency or another cryptocurrency is subject to capital gains tax.

Deductibility of Losses

For traditional gambling, recreational gamblers cannot deduct their losses, but professional gamblers can. For crypto gambling, losses may be deductible as capital losses to offset capital gains but not against regular income.

Reporting Requirements

Crypto gambling winnings must be reported as either business income or capital gains on the tax return, depending on the CRA’s classification:

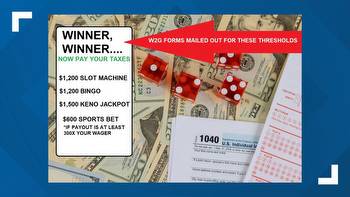

- Professional gamblers would need to report a gambling income using Form 1040 for winnings, Form 1040 Schedule A for losses, and Form 1040 Schedule C for expenses.

- Capital gains earned from crypto should be reported using Form 8949.

Fiat gambling winnings generally do not need to be reported on tax returns for recreational gamblers.

When Are You Taxed for Purchasing Cryptocurrencies For Gambling?

When is cryptocurrency purchase exempt or taxable, since the CRA treats it as a commodity and not a currency?

Exempt From Tax

- Buying Crypto with Canadian Dollars (CAD): Buying cryptocurrencies with CAD is not taxable. This is because the CRA views the acquisition of the cryptocurrency as simply the purchase of an asset, quite similar to buying property, stocks or any other investment. There is no tax owed on the purchase itself, only on any future gains or losses when the cryptocurrencies are eventually sold or disposed of.

- HODLing Crypto: HODL is a cryptocurrency that is traded and tracked in Canada. HODL refers to both the specific cryptocurrency token as well as the broader investment strategy of holding cryptocurrencies long-term. Holding on to crypto without selling or disposing of them is tax-free. You do not owe any taxes until you realize a gain by selling, spending, swapping, or gifting the crypto.

Taxable

- Buying crypto with crypto or altcoins: Cryptocurrencies like Bitcoin, Litecoin, and Ethereum to buy another cryptocurrency is considered taxable by the CRA. This means that you would owe capital gains tax on any increase in the value between when you acquired the original crypto and when you used it to buy the new one. The CRA views crypto-to-crypto transactions as the sale of original cryptocurrency, regardless if it is being used to buy a new crypto asset. The reason for this is that it can trigger a taxable gain or loss event.

- Using stablecoins: Stablecoins are taxable and are viewed as any other cryptocurrency by the CRA. Any buying, selling, or using them are considered capital gains tax. Even if the stablecoins are used for transactions like online casino deposits or winnings, the CRA views them as commodities rather than investments.

The Bottom Line

Unlike traditional gambling, crypto gambling winnings are considered taxable income and must be reported on tax returns. The winnings are taxed at the individual’s normal federal and provincial income tax rates. The Canada Revenue Agency’s standard income and capital gains tax rules apply to all crypto gambling activities, both domestic and international. Whether you dabble in Bitcoin casinos for fun or are a professional gambler, any disposition or transaction must be reported for tax purposes. Failure to do so will result in severe penalties or could lead to a full investigation or audit.