Viva, Las Vegas: Investors Gamble on Reopening

“Bright light city gonna set my soul. Gonna set my soul on fire. Got a whole lot of money that’s ready to burn. So get those stakes up higher…”

As the economic expansion accelerates and second quarter 2021 operating results continue to beat expectations, among the biggest winners are hotels, restaurants, and leisure venues, all of which suffered the greatest damage during the worst of the coronavirus pandemic last year.

Hitting the jackpot are bricks-and-mortar casino resorts headquartered in Las Vegas, Nevada. The following chart depicts a comeback worthy of Elvis:

Let’s examine why these “reopening plays” are bellwethers for the rest of the economy. Their renewed prosperity bodes well for the stock market in the second half of 2021.

For Q2 2021 to date, the blended earnings growth rate for the S&P 500 is 88.8%. The consumer discretionary sector is reporting the second-highest year-over-year earnings growth rate of all 11 S&P 500 sectors, at 268.5%. The industrials sector comes in at number one, at 408.7%.

The “hotels, restaurants, and leisure” sub-segment, which includes gaming, is the largest contributor to earnings growth in Q2 for the consumer discretionary sector. (These numbers come from research firm FactSet, as of August 9.)

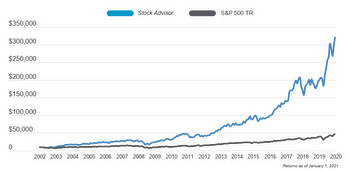

The blended year-over-year revenue growth rate for the entire S&P 500 for Q2 2021 is 24.7%, as the following chart shows:

This Q2 revenue growth rate of 24.7% is well above the five-year average growth rate of 4.5% and the 10-year average of 3.4%. The S&P 500 is currently reporting the highest revenue growth rate in at least 13 years.

Vegas, baby…

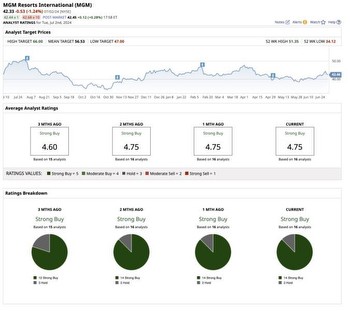

So, which companies are leading the revenue race? Among all S&P 500 companies, these four brand name gambling resorts have reported the largest year-over-year increases in revenues on a percentage basis (at the company level, in order of magnitude):

Caesars Entertainment (NSDQ: CZR), at +1,878%; Las Vegas Sands (NYSE: LVS), at +1,097%; Wynn Resorts (NSDQ: WYNN), at +1,055%; and MGM Resorts (NYSE: MGM), at +683%. All four are headquartered in Las Vegas.

To be sure, online gaming has made big strides, especially during the pandemic, but consumers with cabin fever have been eager to visit physical establishments as well.

Analysts expect the S&P 500 to continue to report double-digit revenue growth for the remainder of 2021. The estimated revenue growth rate for Q3 2021 is 14.4%, while estimated revenue growth for Q4 2021 is 11.0%.

The persistent danger, of course, is the spread of COVID Delta. That fear weighed on markets Monday. The Dow Jones Industrial Average fell 106.66 points (-0.30%), the S&P 500 slipped 4.17 points (-0.09%), and the tech-heavy NASDAQ rose 24.42 points (+0.16%). The U.S. dollar hit a four-month high as robust employment data caused Wall Street to expect Federal Reserve tapering sooner than expected.

In pre-market futures trading Tuesday, U.S. stocks were little changed, as investors await each day’s latest COVID statistics with trepidation.

But where some analysts see doom-and-gloom, I see silver linings. Many people who were against getting vaccinated are changing their minds. Vaccination rates are dramatically rising in all 50 states, as public health officials pull out the stops to counter misinformation about vaccines.

The COVID narrative has shifted. Media outlets that previously railed against vaccines are now getting on board. Wall Street is jittery about the Delta variant but, rightfully so, hasn’t panicked.

Meanwhile, recent employment reports show that job gains have been the highest among hotel, restaurant, and leisure companies.

The Institute for Supply Management reported last week that service sector activity rose a record 64.1% in July from 60.1% in the previous month, beating the consensus forecast of 60.5%. Hospitality and leisure activities led the gain.

Granted, the baseline is abnormally low due to the payroll carnage of last year. Nonetheless, the evidence is clear: the economy is on the mend, with the pursuit of fun in the vanguard.

The benchmark Invesco Dynamic Leisure and Entertainment ETF (PEJ) has generated a year-to-date daily total return of 23.5%, compared to 18.8% for the SPDR S&P 500 ETF Trust (SPY), as of market close August 9.

The upshot: Despite fluctuating pandemic fears, the shrewd move is to bet on “reopening” stocks. Consumers are flush with household savings and, as the song goes, they’ve got a whole lot of money that’s ready to burn. Stock market history shows that you should never bet against the consumer.

Meanwhile, as the global economic recovery picks up steam, countries around the world will consume vast amounts of raw materials. That’s a boon for the commodities sector.

Commodities not only confer outsized growth during economic expansions, but they also provide a hedge against risk. For details about our investment team’s favorite commodities play, .

John Persinos is the editorial director of Investing Daily. Send your questions or comments to mailbag@investingdaily.com. To subscribe to John’s video channel, .