Las Vegas Sands: Still Too Cheap To Ignore, Macau Joins Singapore In Recovery Cycle (LVS)

"Time will bring to light whatever is hidden; it will cover up and conceal what is now shining in splendor…"

Horace (65BCE ---8BCE.)

The double whammy of covid and inflation has for three years battered the consumer discretionary sector, but full force recession had thus far been kept at bay. Now we have the SVB Financial Group (SIVB) failure and feared contagion to come igniting forces of recession already as other sleeper recession agents like growing layoffs awaken. So Mr. Market remains confused, gets more shaken, and flees to refuge asset classes. That's an admittedly a bear outlook on a U.S. economy that may lie ahead. Yet, the casino business will absorb the blows as it historically had done and recover in time. We are in a waiting game again.

But the real story in uncovering value plays in the space now, lies in the Asian gaming stocks. And one poised for bigger upsides over the next 19 months is Las Vegas Sands Corp. (NYSE:LVS) - head and tailwinds ahead notwithstanding.

We don't imply that Asia is or will be immune to the billowing headwinds buffeting the U.S. economy now. As with everything related to Asia gaming, China holds the key hand. A combination of global economic threats compounded by its zero covid tolerance policy have blitzed the China economy.

Part of the nosedive outside of covid has been the discernable shift in stiffening Beijing outlooks on what has been a near miraculous run fueled by capitalism since the reforms of Deng Xiao Ping between 1977 and 1987. His drive away from orthodox communist doctrine opened up the nation to its capitalistic free enterprise entrepreneurial skill sets. Its y/y GNP growth was spectacular, moving into double digits.

The ascension of Xi Jinping triggered a slow, but steady, move away from Deng's reforms to a China reined back to its ideological communist policy outlooks. Under Xi, it has become ever hungrier for global economic and military power.

Xi has positioned himself at center stage of world events, perhaps not rattling sabers yet, but unsheathing them with ever more hostile policy statements toward a U.S. he sees as weakened. At the same time, he takes the lead in global events by playing honest broker in the Mideast conflicts and within the last few days as an arbiter in the Ukraine war he was scheduled to see Zelensky. Perhaps part of this stance is a political ploy to distract attention from the beating taken by the China economy by the failed zero covid policies.

GNP projected for this year by official sources is 5%. That is number one of several metrics many followers of the gaming sector cite as a possible cause for not getting too giddy about a Macau recovery cycle too soon. Wrong. What we have seen since zero-covid was abandoned in early January is a surging return to Macau by mainland customers far beyond the most bullish outlooks to that point.

Macau officials were looking for 200,000 arrivals for Chinese New Year. Over 600,000 came, bringing GGR win for January and February over the US$1b mark for each month. It is a clear signal that the momentum of Macau recovery is not slow and safe, but roaring ahead to where baseline 2019 revenue targets are coming in sight closer than expected.

Above: Nice beginning, but just the beginning of a greater climb ahead.

As we have noted, forecasts for 2019 GGR pre-zero cancellation were $9b for official, to $16b from analysts, to our own $18b for 2023, with 2024 scraping near or at baseline 2019 total recovery. Since the first two months of this year, Morgan Stanley (MS), among others, have once more raised GGR expectations to $22b for 2023 and a run rate approaching even to 2019 by 2024.

Based on our intelligence network of Asian associates calculated against our internal tracking of the pent-up demand factors we see, we are now raising our own GGR forecast for the year to $27.4b and guiding 2024 to anywhere between $33b to $39/$40b - near or past baseline 2019. All this in the teeth of global shakings beginning to show up on the Richter Scale of possible financial meltdowns of the type experienced in 2007-09. Asia is not immune, but history shows gamblers show no matter the economic turmoil. GGR is dented but not dead.

LVS 4Q22 results were a Singapore story with Macau still in the highly problematical state, but all that has changed

LVS reported its Marina Bay Sands Singapore property had doubled its 4Q22 revenues to $682m from $368m in 2021. Hotel occupancy hit 98% moving robustly into operating profit territory. The performance clearly reflected the Singapore government's reopening policies put into place, ending all lockdowns by mid-year 2022. While Singapore recovery was well underway, Macau remained victimized by China's zero covid policies until after January 8, when lockdowns ended.

Tourist arrivals soared to 1.377m in January up 101% y/y. Of these, mainland China contributed 991,641 up 54.5% y/y, Hong Kong 356,549 up 704% and Taiwan, 18,800 up 13% y/y.

It is now clear that 1Q23 results at the end of this month are likely to beat top and bottom line forecasts unless there is an unusual run of unlucky play.

So, at the time of reporting its 4Q22 and annual results in January, LVS had yet to feel the force of pent-up demand from its primary Macau feeder markets. And when they did begin to appear for Chinese New Year, it became apparent that the recovery cycle would be much faster than expected, sending many analysts back to their algorithms to refigure market performance. That sets the stage for our premise here:

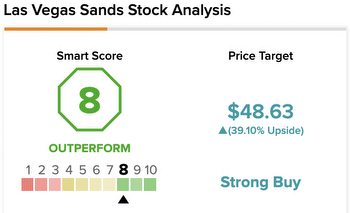

We believe that at its current price, up nicely from its last fall trading range, LVS remains a strong buy.

In our last LVS post on January 20 th we put a price target ("PT") of $67 on the shares to be reached by 2Q23. The price that day was $54. Just prior to that post, we did an article on November 14, 2022, when LVS stock traded at $43. So clearly the more bullish news out of Asia and growing analyst sentiment toward buy was a story heard and acted upon. Now LVS stock seems settled in at ~$55

It is time to take another pass at a PT beyond our prior guidance at $67 by 2Q23.

Macau joins the LVs engines already firing in Singapore

One- year analyst consensus PT: $67.

Our revised PT: From $67 to $73 by 2Q23, or a tad more than 30% up. The understandable question here: where is this going to come from? I arrive at $6 above analyst PT consensus here based on the following factors:

The LVS share of the Macau market will benefit disproportionately from the surging increases in GGR ahead because it begins with the largest room inventory in Macau, with over 12,000 total, first class rooms and suites. We expect the recovery arrivals to be led by mass segment players with an average spend recalculated above $700. Part of that is related to our own research, with Macau associates into the player mix changes favoring the upper segment of mass comprised of the entrepreneurial small business operators.

New arrivals are not premium mass, but customers who have kept gaming budgets unspent, according to my associates. "They are arriving with full pockets," said one casino manager. It is easy to gainsay this if set against the macro China economy's anticipated slow recovery at a 5% GNP rate. But as par for the course, I have long believed that the macro factors sometimes attributed to having a potential major damage impact on Macau gaming do not materialize.

Back in the day, while operating in a c-suite property, I commissioned a study of the gaming proclivities of key components of our customer base-domestic and international. It would be no surprise going in that persons of Chinese or Asian ethnicity would show a stronger than average penchant to participate in recreational gambling.

The question I sought to answer was just how wide was the gap between our China customers and domestic ones? It came out as `37% higher than that the overall average. The closest groups after the Chinese were more indicative of the metro NY/Philadelphia ethnographic makeup than many other regional gaming properties. With Jewish and Italian-American groups coming after Chinese.

I shared this study with friends in Macau, who confirmed that even among all Asian populations, people of Chinese ancestry or part Chinese, had a discernable higher gaming profile than other groups. Part of this was linked to the higher proportion of Chinese customers engaged in small businesses rather than as employees of large corporations. In Macau, younger p-layer groups tend to be more representative of large economy enterprises as employees, but their gaming characteristics are still higher than their millennial cohorts elsewhere.

Return to dividends?: What investor in Las Vegas Sands Corp. has not remembered the cheering words of founder Sheldon G. Adelson (d.2021) when announcing earnings results. "Yay Dividends!" Sheldon called out. Why not, since Sheldon was collecting over 50% of the haul. The payout by 2017 had risen to $3.03 or a yield of 7.4%--pretty nifty by any measure at the time. Since then of course dividends have fallen to the axe of covid. But given its currently flush cash position of $6.3b (mrq) against total debt of $13.947b down 5.26% from 2022 and our expectation of earnings beats throughout the year, we believe we can anticipate a return to a Las Vegas Sands Corp. dividend payout at some point late this year. It is really part of the LVS culture of share and share alike.

Near-term maturities will comfortably be met. Current ratio for LVS sits at 1.73, reflecting that comfort level.

Earnings estimates

Analysts' consensus 2023: $1.87 on $8.6b in revenue.

Our estimate for this year: $2.25 per share on revenue of $9.8b with continued focus on cost savings instituted during covid. Many will become permanent improvements in operating margins as they stay in place as the post covid era goes ahead.

Prospects for either New York or Asia

Las Vegas Sands Corp. sees itself as a premier developer of integrated casino resorts as a key part of its skill set going forward. It has proven its case both in Macau and Singapore. All but forgotten now is the skepticism thrown at founder Adelson all those years back, when he demolished the old Las Vegas Sands property and built his first integrated resort debuting as the Venetian in 1999.

I can remember clearly how many analysts scoffed at his idea that there was money to be made big time off the casino floor by attracting conventions and meetings. Casino veterans such as myself can indeed remember the day when convention business was considered worthless because the badge-wearing, handshaking conventioneers, rarely showed up on the casino floor. Adelson took his growth blueprint to Macau and Singapore and established a pathway for an entire industry.

Having sold the Las Vegas assets (to the regrets of both many shareholders and industry observers as being too soon), Las Vegas Sands Corp. stands its ground awaiting its next test. That could come soon if the New York officials, who are due to pick operators for downstate casino sites soon, tap LVS.

They have a prime location in a nearby suburb. And their development engines will be firing as soon as they get the nod. Even though a possible NY opening could be four years away, it is pretty clear they will put together a temporary casino site focused on slots and low limit table games asap. The other contingency is a third Asian nation, long in the pot boiling primarily due to covid. Las Vegas Sands Corp. will have both eventually. But near term, this year, could see the NY nod that will bump the stock from jump street.

Conclusion

There remains many skeptics about Las Vegas Sands Corp. among Mr. Market participants. Part of that understandably comes from the fact, as we have noted in our last article, that over 50% of Las Vegas Sands Corp. equity is still held by Adelson family interests and trusts. That limits to a degree participation by a much larger universe of retail investors seeking both returns and yield-both of which are attainable goals in stocks like LVS.

Another part comes from concerns about its geriatric management and board that continues to be an issue. It was one while Adelson lived because of his age and his seeming reluctance until late in the game to anoint Goldstein. Behind gaming veteran Goldstein, who is in his mid-sixties, is Patrick Dumont, son-in-law of Adelson's widow, Dr. Miriam Adelson. He is 47, with a finance background.

As long as the savvy Goldstein steers the ship to its next safe harbor, Las Vegas Sands Corp. will be moving in a voyage of Adelson's vision. And we believe LVS remains one of the most persistently undervalued stocks in the sector because of its current ownership structure. That will change because moving equity into the public ultimately benefits both the Adelson interests as well as shareholders. It is Dr. Adelson's ultimate call.

There is always more that is hidden in stocks than are revealed even by the best metrics one can summon as an investor. And the best place to start such a process is to look deep into the origins and execution successes of top management guided by a very specific sense of mission in the head or imagination of the founder. That is where the valuation most critical lies.