3 Casino Stocks to Watch As Land-Based Gambling Declines

Casino stocks have had a tough 2020 due to declining revenue, at least for traditional casino stocks with physical locations and no online games. Still, something unorthodox happened to some casino stocks: soaring stock prices in the face of declining revenues. Are casino stocks now a safe bet on the global economic reopening and the return to normality for business, traveling and gambling?

The American Gaming Association in a press release in Feb. 2021 mentioned the following which shows the dramatic decline of revenue for the gaming industry, which applies to gaming stocks too.

“U.S. commercial gaming revenue totaled $30.0 billion in 2020, down more than 31 percent year-over-year,” according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. 2020 marked the first market contraction for the U.S. gaming industry since 2014 and the lowest gaming revenue total since 2003.”

“The year ended with some positive momentum in the fourth quarter, with a 1.7 percent increase in revenue over Q3 2020. The nearly $9.2 billion in revenue still represented a 17 percent year-over-year decrease.”

And what is notable to mention is that although 2020 was a bad year for gambling stocks, better days are to be expected. The press release offers valuable information. It also mentions that “The impact of COVID-19 on the casino industry extends beyond gaming revenue. Live entertainment, tourism, and meetings and conventions — which make up more than half of casino resort revenue in tourist destinations like the Las Vegas Strip — all came to a standstill in 2020 and are only now starting to reopen.”

This offers an optimistic view that 2021 should witness much better days for casino stocks.

Here are three casino stocks to monitor for this anticipated rebound in the industry.

- Caesars Entertainment, Inc. (NASDAQ:CZR)

- MGM Resorts International (NYSE:MGM)

- Boyd Gaming Corporation (NYSE:BYD)

Casino Stocks to Monitor: Caesars Entertainment, Inc. (CZR)

Two things to mention about CZR stock are the one-year return of 241% as of May 20, 2021, and revenue growth of 37.41% or $3.47 billion in 2020. So has the pandemic not impacted this stock at all?

This can be attributed to the business model that has several iGaming markets in the US region. Plus, let’s not forget the Caesars online sportsbook and the business of online casinos too. Still, there is a big detail to mention that changes the whole picture. The net income reported in 2020 fell dramatically -2,269.11% to -$1.76 billion in 2020, compared to net income reported of $81 million in 2019. This is a too negative a factor to just ignore.

But is there hope now for 2021? The answer is yes. In 2020, Caesars and William Hill struck a business deal with the former acquiring the UK-based sports betting company. There is a report that “Entain Plc, the owner of Ladbrokes betting shops, is considering making a bid for some William Hill assets” and that could mean a nice injection of cash to Caesars Entertainment plus potentially making a nice profit from this deal if materialized.

Second, there was a that “Caesars Entertainment Returns to Full Capacity Gaming Floors at all Las Vegas Resorts” so the recovery is already here.

MGM Resorts International (MGM)

The stock has a one-year return of 160%, and 2020 for sure was a bad year, with revenue plummeting 59.98% to $5.16 billion compared to revenue of $12.9 billion in 2019. The company reported a loss of $997.2 million for 2020 or a decrease of -148.73% compared to the net income reported of $2.05 billion in 2019.

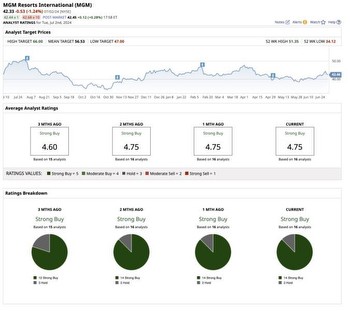

But what are some reasons now to be optimistic and monitor the stock? Analysts at J.P Morgan upgraded the stock to overweight from neutral. The reasons are “momentum at its domestic casinos, particularly in Las Vegas,” continues to “build revenues and margin improvement.”

According to Zacks Equity Research MGM Resorts reported “adjusted loss per share of 68 cents, narrower than the Zacks Consensus Estimate of a loss of 86 cents” and “Total revenues were $1,647.7 million, which topped the Zacks Consensus Estimate of $1,565 million.”

What is also notable is the fact that the company during the Q1 of 2021 repurchased stock or 3.15 million shares. This is considered a strong signal that management is optimistic for the business outlook and prospects.

BYD stock is expected according to Zacks to have an EPS growth of 19.83% for the next three to five years. And it has a PEG ratio of 0.94 signals that it could be undervalued.

Revenue growth fell 34.50% in 2020 to $2.18 billion compared to $3.33 billion in 2019. And as expected came a disruption in the previous profitability that was positive for the years 2015-2019. In 2020 Boyd Gaming had a net loss of $134.70 million, whereas in 2019 it had a net profit of $157.64 million.

The company operates a travel agency too, which will likely benefit from the lifting of pandemic restrictions.

First-quarter 2021 results were strong. “Boyd Gaming reported first-quarter 2021 revenues of $753.3 million, up from $680.5 million in the first quarter of 2020. The Company reported net income of $102.2 million, or $0.90 per share, for the first quarter of 2021, compared to a net loss of $147.6 million, or $1.30 per share, for the year-ago period.”

The rebound in fundamentals is evident for the first three months of 2021. According to Keith Smith, President and Chief Executive Officer of Boyd Gaming “This was an exceptional quarter for our Company, as we achieved the strongest EBITDAR and margin performances in our history. As economic conditions improve and COVID vaccinations continue to roll out, we are seeing increased visitation and growing spend-per-visit across every customer segment.”

News that “Boyd casinos in Nevada return to 100% capacity with no social distancing” is positive too.

I recommend being cautious now and waiting for the confirmation of continuation in the financial improvements over the next quarter or quarters. These 3 casino stocks have potential and may continue to perform well in 2021, but risks during the pandemic have already had negative impacts on their valuations.

On the date of publication, Stavros Georgiadis, CFA did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Stavros Georgiadis is a CFA charter holder, an Equity Research Analyst, and an Economist. He focuses on U.S. stocks and has his own stock market blog at thestockmarketontheinternet.com/. He has written in the past various articles for other publications and can be reached on Twitter and on LinkedIn.