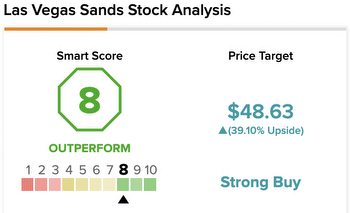

Las Vegas Sands Stock Is A Steal

Las Vegas Sands' stock has declined 50% since the coronavirus crisis. The company has a market capitalization of $27 billion. Draft Kings has $20 billion market cap. Sports betting and iGaming industry in the U.S. is likely to top $40 billion at maturity. Flutter Entertainment’s FanDuel's 40% market share makes DraftKings a second choice for punters.

Draft Kings' revenue is expanding at a rate of more than 50% per year. Las Vegas Sands' revenues declined by 73% to $3.6 billion in 2020. Draft Kings’ Online Gaming, Gaming Software, and Other segments contribute 84%, 12%, and 4% of total revenues. Draft King expects to achieve a 20-30% share of the $21 billion sports betting market and 10-20% of $18 billion iGaming market at maturity.

Before the pandemic, Sands’ Macau, Vegas, and Singapore properties accounted for 63%, 15%, and 22% of total revenues. Draft Kings‘ Online Gaming, Gaming Software, & Other segments contribute 84%, 12%, 4% and 4%. In the past two years, the average monthly unique players and average revenue per monthly player have grown by 47% and 65%. Draft King expects to achieve a 20-30% share of the $21 billion sports betting market and 10-20% iGaming market at maturity.

Draft Kings reported $614 million of revenues and $844 million net loss in 2020. The company burned $338 million on operating cash and raised capital from equity issuances. Las Vegas Sands reported revenues of $13.7 billion and operating profits of 22%. The resort operator returned $3 billion as dividends to shareholders.

Las Vegas Sands reported $13.7 billion of net revenues and $3 billion in operating cash flow in 2019. Draft Kings reported revenues of $614 million and a $844 million net loss in 2020.

Draft Kings has more cash and intangible assets than Las Vegas Sands. Draft Kings' market capitalization is linked to expectations of revenue growth and profitability. Sands's Singapore and Macau properties generate an EBITDA margin of 54% and 36%. Draft King's stock is more valued on expectations for long-term revenue and profit growth.

Las Vegas Sands stock is a steal despite the recent slump due to the coronavirus crisis. Sands has not incurred any impairment charges and its operating cash burn is limited to $1.3 billion in 2020 and $105 million in 2021. The company has $12 billion of property & equipment on the balance sheet. Draft Kings' balance sheets comprises more of cash and intangible assets.