Las Vegas Casinos Should See Bump From Macau Reopening

Macau has been in dire straits for more than the past week.

Earlier this month, the Chinese government announced that it would close all casinos in Macau starting July 11 as the region battles a covid-19 outbreak that infected nearly 1,500 people over a three week period in the city of 680,000.

During previous outbreaks, the Chinese government had been hesitant to shut down casinos, the main economic driver of the region, but this time the gaming industry wasn't spared.

The last time China shut down the casinos in Macau was during the early days of the pandemic in 2020.

Since last Monday, only supermarkets and other essential service providers have been open with police reportedly patrolling the streets for violators who face penalties.

Half a world away, the lockdowns haven't hampered the stocks of the Las Vegas casinos with exposure to the region.

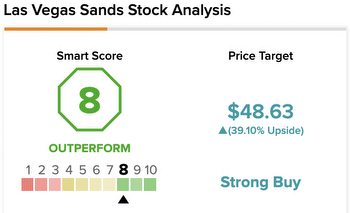

Las Vegas Sands (LVS) - Get Las Vegas Sands Corp. Report was up 9% from July 11-July 19. MGM Resorts (MGM) - Get MGM Resorts International Report was up 4% over the same timeframe and Wynn Resorts (WYNN) - Get Wynn Resorts Limited Report rose more than 5%.

While holding steady during the lockdown, those stocks got a boost on July 20 after the Chinese government announced that it would be lifting restrictions soon.

Las Vegas Gets Macau Bounce

The Chinese government on Wednesday said that it would end the citywide lockdown on July 23. Most nonessential businesses will be allowed open during a trial period ending July 30.

As a result, Las Vegas Sands shares jumped 4.3% at last check July 20, MGM gained 2.9% and Wynn rose 3.8%.

Total gambling revenue in Macau totaled $36 billion 2019, $7.56 billion in 2020 (it's lowest total since 2006) and $10.82 billion in 2021.

In 2019, Macau casinos generated $8.8 billion in revenue for Las Vegas Sands, which sold its Las Vegas casinos earlier this year for $6.25 billion.

Wynn Resorts has two casinos in Macau, the Wynn Macau and Wynn Palace, and just three years ago the region accounted for 70% of Wynn's business.

Before the lockdown, some analysts estimated that the casinos were burning through as much as $600 million a month due to restrictions, according to Reuters.

At the same time, in Las Vegas, and across the U.S., gaming activity has started to return to normal as covid restrictions wane and life inches back to normal. So those stocks could get a boost if Macau is coming back online as a revenue driver.

“While the reopening may be delayed as China pursues its Dynamic Zero Covid policy, our long-term thesis on Macau remains firmly in place,” Bernstein analysts said in a recent note, according to the Wall Street Journal.

“China wants an economically viable and politically healthy Macau and the gaming industry plays a critical role in allowing that to continue.”

Macau's Future

Macau is in flux. While the government has begun renewing casino licenses, Bloomberg reported in March that the local government is likely to demand new investment from companies like Wynn in order to keep operating there.

But that hasn't dimmed the company's hopes for a long, fruitful business in the region.

"As we have seen before, when Macau is more accessible, demand snaps right back. Long-term, I remain incredibly enthusiastic about the prospects for Macau," Wynn CEO Craig Billings told TheStreet earlier this year.

"Between the shift to higher-margin premium mass customers and to customers who have more motivations to visit than just gaming, the market is evolving, and we are prepared to adapt and grow our business as we embrace those changes."