Evolution Gaming: A High-Rolling Online Gambling Stock

Evolution Gaming Group AB (EVVTY) develops, produces, markets, and licenses B2B casino solutions to gaming operators.

It provides live casino studios, land-based live casino, mobile live casino, and live casino for television. Its customers include various gaming/gambling companies, including the well-known DraftKings (DKNG).

However, the major difference between a money-losing company like DKNG and a company like Evolution is profitability, as we will discuss. Evolution Gaming was founded in 2006 and is headquartered in Stockholm, Sweden.

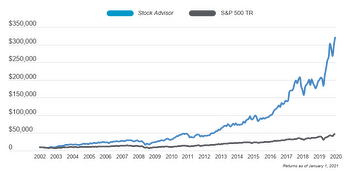

We are bullish on the stock because it has a strong competitive advantage, which allows it to create value for shareholders, maintain a reasonable valuation, and receive backing from analysts. This article will focus on the cold, hard, quantitative numbers that prove that EVVTY is a solid company.

Evolution Gaming’s Competitive Advantage

Evolution Gaming is a company that we believe has a competitive advantage in its industry. So, how did we arrive at this conclusion? Well, there are a few ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by a company’s weighted average cost of capital (WACC), and reproduction value (the cost to recreate a business) can be measured using total asset value. If the earnings power value is higher than the reproduction value, then a company is considered to have a competitive advantage.

For Evolution, the calculation is as follows:

EPV = EPV adjusted earnings / WACC

$7.578 billion = $629 million / 0.083

Since Evolution has a total asset value of $4.44 billion, we can say that it does have quite a strong competitive advantage. In other words, assuming no growth for Evolution, it would require $4.44 billion of assets to generate $7.58 billion in value over time.

The second method to figure out if a company has an edge is by looking at its gross margin trend. The gross margin represents the premium that consumers are willing to pay over the cost of a product or service. An expanding gross margin indicates that a sustainable competitive advantage is present. If an existing company has no edge, then new entrants would gradually take away market share, leading to decreasing gross margins as pricing wars ensue to remain competitive.

In Evolution’s case, gross margins have remained flat at 100% in the past several years. As a result, its gross margins indicate that a competitive advantage is present in this regard as well.

Its 100% gross margin allows for an extremely high free cash flow margin as well. Evolution Gaming’s FCF margin has steadily risen from 16.5% in 2016 to a whopping 56.1% in the past 12 months. This signals improving efficiency and high amounts of operating leverage.

Profitability

Most investors appear to be obsessed with earnings. This is especially true for institutional investors who tend to overreact to the slightest earnings miss. However, these paper profits have the potential to be very misleading, which is why we prefer to focus on free cash flow.

In the last 12 months, Evolution has recorded $720 million in free cash flow, making it profitable by our definition. This indicates that the company doesn’t have to rely on equity raises to continue funding its growth.

More importantly, its free cash flow has been trending up in recent years, as it was only about $20 million in fiscal 2016. The company has surely come a long way. This uptrend means that the company’s free cash flows are reasonably predictable.

Evolution Creates Value for Shareholders

Great companies often have great management teams that can effectively allocate capital to profitable projects. Many professional fund managers tout the importance of meeting with a company CEO to gauge if that person is right for the job.

However, we may be able to get a good picture of management’s effectiveness by simply looking at the numbers. A metric we like to look at is the economic spread, which is defined as follows:

Economic Spread = Return on Invested Capital – Weighted Average Cost of Capital

The idea is very simple; if the return on invested capital is greater than the cost of that same capital, then the company is creating value for its shareholders through well-thought-out projects. Otherwise, the company is destroying value and would be better off simply investing money into risk-free bonds.

For Evolution Gaming, the economic spread is as follows:

Economic Spread = 20.3% – 8.3%

Economic Spread = 12.0%

As a result, the company is creating value for its shareholders, implying that management is efficiently allocating capital.

Risks

To measure Evolution’s risk, we checked if financial leverage is an issue. We do this by looking at its debt-to-free-cash-flow ratio. Currently, this number stands at 0.1. In addition, when looking at historic trends, the debt-to-free-cash-flow ratio has been trending down.

Overall, we don’t believe that debt is currently a material risk for the company because its interest coverage ratio is 390 (calculated as EBIT divided by interest expense). In other words, it can cover its annual interest payments 390 times over using its operating earnings.

However, there is an industry-specific risk that investors should be aware of. Since online gambling can be harmful to people with addictive personalities, many governments have placed restrictions on it.

Nevertheless, online gambling websites work around these restrictions by moving operations offshore where they can’t be prosecuted by foreign governments.

Wall Street’s Take

Turning to Wall Street, Evolution Gaming has a Moderate Buy consensus rating based on two Buys and two Holds assigned in the past three months. The average Evolution Gaming price target of $kr1,396.25 implies 38.8% upside potential.

Final Thoughts

Evolution Gaming is a solid business with strong fundamentals. The company has a measurable competitive advantage and reasonably predictable free cash flows that have allowed it to create value for shareholders.

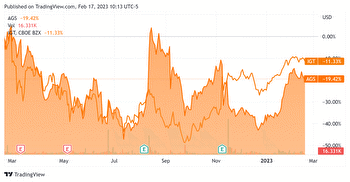

In addition, the company has very little debt and the backing of analysts that expect strong upside from current levels after it has come down about 50% from its highs.

Its price decline leaves it at a 26x forward price-to-free-cash-flow ratio for fiscal 2022, as analysts expect €789.2 of FCF for the year. We believe this is a very reasonable price for a highly-profitable company in a high-growth industry. Therefore, we are bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure