Las Vegas gaming equipment manufacturer PlayAGS narrows losses in fourth quarter

PlayAGS Inc. is hoping to build on the successful conclusion of 2021 and its narrowing of losses, the company’s top executive said Thursday.

“If 2020 was the year of resiliency within our business, 2021 was the year of transition,” said PlayAGS President and CEO David Lopez. “Supported by the foundational changes put into place over the preceding 18 months and an accommodative macroeconomic backdrop, we were able to establish operating momentum within all three business verticals as we progressed throughout the year, a trend that continued into the fourth quarter.”

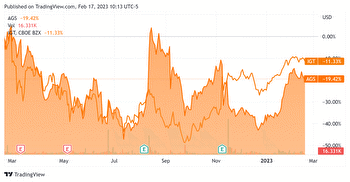

The Las Vegas-based gaming equipment manufacturer reported a net loss of $9.1 million, 25 cents a share, on revenue of $70.2 million for the quarter that ended Dec. 31. For the same quarter a year earlier, the company lost $17.2 million, 49 cents a share, on revenue of $46.6 million. In the fourth quarter of 2021, revenue was up 50.6 percent from the previous year, but down 9.7 percent from the fourth quarter of 2019.

For the full year, PlayAGS posted a net loss of $22.6 million, 62 cents a share, on revenue of $259.7 million. That compared with a net loss of $85.4 million, $2.40 a share, on revenue of $167 million in 2020.

The company barely beat analysts’ revenue and earnings projections for the quarter. A survey of seven analysts on average expected revenue of $69.1 million for the period.

Carlo Santarelli, a gaming industry analyst in the New York office of Deutsche Bank, said that on the call, executives outlined key areas of focus and the operating momentum in the business heading into 2022.

“Investments in research and development would somewhat mitigate the operating leverage dynamics that would otherwise likely accompany stronger gaming machine unit sales and steady participation revenue performance,” Santarelli said in a note to investors. “That said, we expect healthy, and perhaps conservative, mid- to high-single-digit adjusted cash flow growth, despite what we anticipate could be compressed adjusted cash flow margins in 2022.”

Following on its improved 2021 financial results, the company’s focus “has shifted to ensuring we are best positioned to achieve even greater success in 2022,” Lopez said. “To that end, I would characterize 2022 as a year of acceleration for AGS; one in which we will look to further leverage the continuous improvement in our people, products and processes to strengthen our financial performance.”

PlayAGS, a subsidiary of Apollo Global Management Inc., the new owner of The Venetian and Palazzo, owns the Burning Tiger, Capital Gains and Cat’s Eye franchises of slot machine games.

PlayAGS also reported its sixth consecutive quarter of growth in its table-game segment.

Internationally, the company announced that it will discontinue its operations in the Philippines and it is closely monitoring contractors it works with in war-torn Ukraine.

The company also reported that last month it successfully completed the refinancing of its debt through the issuance of a $575 million senior secured first lien term loan. The transaction lowered the principal amount of debt owed by about $40 million and reduced annualized cash interest expense by about $10 million.

PlayAGS shares, traded on the New York Stock Exchange, closed up 15 cents, 1.9 percent, to $7.87 a share on Thursday in volume slightly below the daily average.

rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.