Light and Wonder cites balance sheet improvement via lottery division sale

Light & Wonder used the sale of its lottery business division to pay down debt and grow its other operating segments, the company said on an earnings call Tuesday.

Light & Wonder reported a net loss of $67 million, 72 cents a share, on revenue of $572 million for the quarter that ended March 31. In the same quarter in 2021, the company — then known as Scientific Gaming — posted a net loss of $88 million, 98 cents a share, on $453 million in revenue.

“From a balance sheet perspective, we’ve made tremendous progress since our last earnings call,” chief financial officer Connie James said on the call. “Following our closing of the lottery sale on April 4, we took advantage of a window in the capital markets and moved quickly to pay down our debt and successfully complete a series of debt refinancing transactions delivering on our promise to transform our balance sheet.”

Officials attributed the decreased net loss to the higher operating income from revenue growth for its three operating segments: gaming, SciPlay and iGaming.

Investors on the call asked company officials how inflation and supply chain disruptions were affecting the business. The company said it invested in supply chain talent more than 18 months ago to prepare for any issues that might arise and primarily face issues with timing.

CEO Barry Cottle noted while the macro environment is facing volatile conditions from inflation, gross gaming revenues have been elevated into April.

“It truly demonstrates, I think, the durability and resiliency of our business,” he said. “And we do that whether we’re looking at gaming, iGaming or social. We’re actually seeing strong and growing GGR across those three markets. And where we have a view into the high end and the low end of the sectors, we’re seeing demand on each side.”

Light & Wonder closed on the sale of its lottery business to Brookfield Business Partners LP on April 4, generating $5.6 billion in gross cash proceeds. Cottle said the sale gave more financial strength and flexibility to prioritize paying down debt, repurchasing shares and investing in growth.

Funds from the lottery division’s sale were primarily used to pay down debt, officials said. The net debt leverage ratio peaked more than a year ago at 10.5 times and has since dropped to the adjusted net debt leverage ratio at 3.7 times after the lottery sales and refinancing transactions. The company believes it’ll achieve its target ratio range of 2.5 to 3.5 times with the sale of its sports betting division. That sale is expected to close in the third quarter and is subject to regulatory approval.

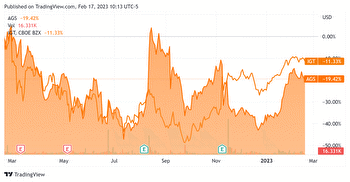

A $750 million share buyback program was authorized in March and the company has purchased about $140 million of the stock, or about 2.4 million shares, through last Friday.

Light & Wonder’s SciPlay acquired Alictus, a casual game developer. Additionally, iGaming acquired Playzido, a content creation platform provider and game supplier.

Light & Wonder shares, traded on the NASDAQ, closed Tuesday at $47.66 per share.

McKenna Ross is a corps member with Report for America, a national service program that places journalists into local newsrooms. Contact her at mross@reviewjournal.com. Follow @mckenna_ross_ on Twitter.