Singapore resort keeps Las Vegas Sands afloat as Macau continues to crater

For the near term, Las Vegas Sands is a single casino company.

Sands sold its Las Vegas holdings in February and its Macau casinos are operating at roughly 50 percent following a two-week shutdown tied to increased COVID-19 infections. The company relies on the Marina Bay Sands in Singapore for the majority of its revenue and cash flow.

Last week, Las Vegas Sands said the second quarter results from Marina Bay Sands in Singapore included $319 million in cash flow while revenue jumped 107.6 percent to $679 million. However, the company took a net loss of $414 million because Macau revenues were down 56.7 percent to $367 million.

“Investor appetite for Macau names remains zilch, which we believe creates an interesting setup,” Stifel Financial gaming analyst Stephen Wieczynski told investors in a research note following Las Vegas Sands’ quarterly earnings announcement.

“Nobody has any clue how much longer China will continue down this path in search of zero COVID cases,” Wieczynski said. “This could drag on for another year for all we know.”

Singapore, however, relaxed much of its COVID-19 restrictions in the spring, which sped up activity at Marina Bay Sands, one of two casino-resorts in the island nation.

“We expected the Singapore recovery to accelerate in the second quarter, but the gaming revenue recovery at Marina Bay Sands has been much better than expected,” wrote CBRE gaming analyst John DeCree. “We still see plenty of room for further recovery at Marina Bay Sands.”

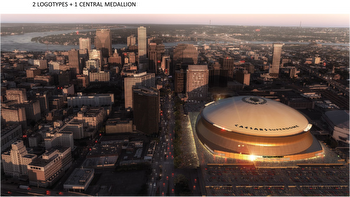

Las Vegas Sands announced plans in 2019 to spend $3.3 billion on Marina Bay Sands in a non-gaming expansion that would include a 15,000-seat arena, a 1,000-room hotel, and additional convention space.

The pandemic slowed the timeline for the plans, and then the death of company founder and largest stockholder Sheldon Adelson, along with the $6.25 billion sale of the Venetian, Palazzo and Venetian Expo, pre-occupied the company executives.

During a conference call with analysts a week ago, Sands Chairman and CEO Rob Goldstein said the company would initially spend $1 billion of the capital investment budget on new hotel suites and other amenities.

Goldstein said additional features would be developed this year and into 2023.

“We look forward to substantially increasing our investment in the Singapore market as we execute our expansion plans at Marina Bay Sands in the years ahead,” Goldstein said in prepared remarks at the outset of the call. “Singapore remains in an outstanding market for additional investment.”

Analysts said Singapore is in the initial stages of its recovery. Passenger volume at Changi Airport was less than half of pre-pandemic levels in June. However, DeCree believes Singapore will benefit from Macau’s troubles.

“The depth of the local market is apparent, and with Macau virtually shut down still, Singapore remains a key beneficiary of displaced gaming customers across regional Asian markets,” DeCree said.

Much of the current international visitation to Singapore is coming from closer markets, including Indonesia and Malaysia.

Unlike Macau, where the zero-COVID policy leads to restrictive quarantine rules, travel restrictions and business shutdowns, Singapore introduced a “Vaccinated Travel Framework,” which is part of the city-state’s strategy of “Living with Covid.”

J.P. Morgan gaming analyst Joe Greff said the plans work to Las Vegas Sands’ benefit, given the uncertainty in Macau.

“At current levels, Singapore operations account for 55 percent of Las Vegas Sands’ market capitalization,” Greff said. “Our sense is that when we point this out to investors, they are surprised it is that high.”

Analysts have all but written off Macau, despite the limited reopening last weekend.

For the first six months of 2022, Macau's gaming revenue is $3.26 billion, down 46.4 percent from a year ago when Macau casinos collected $10.8 billion. In pre-pandemic 2019, Macau casinos produced $36.6 billion.

“We could see a scenario in which China slowly starts to ease up on their restrictive COVID stance which in turn should create a massive pent-up demand burst across China,” Wieczynski said in a research note.

He predicted the “pent-up demand from the typical Chinese gambling consumer could be even higher than what was witnessed in the U.S. over the past year and a half.”