MCRI: Feeling Lucky? Buy These 3 Under the Radar Casino Stocks

The gambling industry is making a comeback with the gradual easing of social distancing mandates. U.S. gambling revenue hit a record $13.6 billion in the second quarter. In-person gambling was the primary driver of the record-breaking second-quarter revenue results. Mobile sports betting and iGaming kept the industry afloat during the initial months of the COVID-19 pandemic as interest in online casinos increased considerably.

According to the American Gaming Association, casinos in nearly every state saw their gambling revenue outdo their pre-pandemic levels in the last quarter. Brick-and-mortar casinos’ revenues were up nearly 10% from their previous high in the third quarter of 2019. In addition, revenue from slot machines was 16% better than in the second quarter of 2019.

The industry has been witnessing remarkable growth, and this momentum is expected to continue. Given this backdrop, we think casino stocks, Monarch Casino & Resort, Inc. (MCRI), Century Casinos, Inc. (CNTY), and Full House Resorts, Inc. (FLL), should be valuable additions to one’s portfolio.

Monarch Casino & Resort, Inc. (MCRI)

MCRI, through its subsidiaries, owns and operates the Atlantis Casino Resort Spa, a hotel/casino facility in Reno, Nevada. It also owns and operates the Monarch Casino Resort Spa Black Hawk in Black Hawk, Colorado. MCRI is headquartered in Reno, Nev.

For the second quarter, ended June 30, MCRI’s net revenue increased 544.8% year-over-year to $97.72 million, while its adjusted EBITDA stood at $35.17 million, up 7,077.3% from the same period last year. The company’s net revenue and adjusted EBITDA reached their all-time highs for the second consecutive quarter. Also, its net income grew 517.5% from its year-ago value to $18.15 million. MCRI’s EPS increased 487.5% year-over-year to $0.93.

A $367.49 million consensus revenue estimate for the current year indicates a 99.3% increase year-over-year. The Street expects the company’s EPS to rise 155.2% from the prior year to $3.19 in the current year. MCRI has a notable earnings surprise history; it beat the consensus EPS estimates in three out of the trailing four quarters.

Over the past year, MCRI has gained 40.9% to close yesterday’s trading session at $66.20. In addition, the stock has gained 8.1% in price year-to-date.

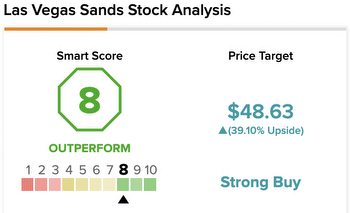

MCRI has an overall A rating, which translates to Strong Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 different factors, with each factor weighted to an optimal degree.

MCRI has an A grade for Sentiment, and a B for Growth, Momentum, and Quality. Among the 31 stocks in the Entertainment – Casinos/Gambling industry, MCRI is ranked #5.

Century Casinos, Inc. (CNTY)

CNTY operates as a casino entertainment company worldwide. The Colorado Springs, Colo., company develops and operates gaming establishments and related lodging, restaurant, horse racing, and entertainment facilities.

On April 14, CNTY announced that its partners, Rush Street Interactive and William Hill, launched their online casino platforms in West Virginia using Mountaineer Casino, Racetrack & Resort’s license. With online casino gambling legalized, the company should open new opportunities to engage more customers and improve its market share.

CNTY’s net operating revenue increased 155% year-over-year to $92.19 million in its fiscal second quarter, ended June 30. Its earnings from operations grew 957% from its year-ago value to $18.11 million. Its net earnings attributable to CNTY shareholders improved 154% year-over-year to $6.86 million, and the company’s EPS increased 151% year-over-year to $0.22.

Analysts expect CNTY’s revenues to increase 22.4% year-over-year to $372.48 million in the current year. A $0.64 consensus EPS estimate for the current year indicates a 139.5% rise from the last year. Furthermore, the company surpassed the Street’s EPS estimates in each of the trailing four quarters. Shares of CNTY have gained 93.7% in price over the past year and 107% year-to-date.

The company’s strong fundamentals are reflected in its POWR Ratings. CNTY has an overall A rating, which equates to Strong Buy in our proprietary POWR Ratings system. The stock also has an A grade for Sentiment, and B for Growth, Value, Momentum, and Quality. In addition, it is ranked #3 in the Entertainment – Casinos/Gambling industry.

To see the CNTY rating for Stability and additional details,.

Full House Resorts, Inc. (FLL)

Las Vegas, Nev.-based FLL owns, develops, invests in, operates, manages, and leases casinos and related hospitality and entertainment facilities in the United States.

FLL’s revenues increased 226.9% year-over-year to $47.44 million in its fiscal second quarter ended June 30. Its operating income grew 393% from its year-ago value to $12.21 million. FLL’s net income came in at $5.48 million, indicating an 181.8% rise year-over-year. The company’s EPS increased 160% year-over-year to $0.15.

The Street expects FLL’s revenues to rise 42.6% year-over-year to $179.05 million in the current year. The company’s EPS is expected to increase 1,600% year-over-year to $0.17 in the same period. FLL has gained 280.3% in price over the past year and 110.9% year-to-date to close yesterday’s trading session at $8.29.

It’s no surprise that FLL has an overall B rating, which equates to Buy in our POWR Ratings system. In addition, it has an A grade for Sentiment, and a B for Value, Momentum, and Quality. FLL is ranked #7 in the Entertainment – Casinos/Gambling industry.

Get additional POWR Ratings for Growth and Stability here.

MCRI shares were trading at $65.34 per share on Friday afternoon, down $0.86 (-1.30%). Year-to-date, MCRI has gained 6.73%, versus a 22.05% rise in the benchmark S&P 500 index during the same period.