BetMGM Announces Launch Of Wheel Of Fortune Online Casino; Mobile App Now Available In New Jersey

BetMGM has launched Wheel of Fortune Online Casino in collaboration with IGT, making it the first brand-led online casino in North America. The casino is now live in New Jersey, offering players a variety of themed games and features, including America’s Game®-branded slot titles. The Wheel of Fortune brand has been a prominent staple on casino floors for over 25 years. The launch of Wheel of Fortune Online Casino represents the latest gaming expansion of the iconic American game show. The mobile app is now available for download on iOS and Android devices. Customers can access responsible gaming tools through the GameSense integration within BetMGM’s mobile and desktop platforms.

IGT Reports Q4 2022 Revenue of $1.06 Billion and Returns to Profitability

☝️Learn what media think of IGT stock.☝️

Check our new FREE NEWS SENTIMENT TOOL.

International Game Technology (IGT), a leading gaming and lottery company, has reported a revenue of $1.06 billion in the fourth quarter of 2022. This represents a 3% increase compared to the same period in the previous year. The company also returned to profitability with a net income of $72 million, compared to a net loss of $168 million in Q4 2021.

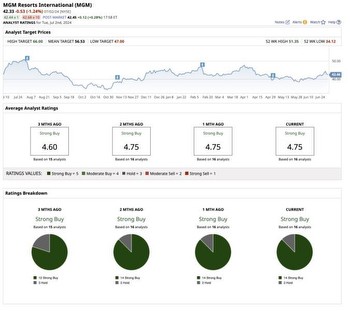

While IGT’s stock price has experienced volatility over the past year, it is currently at $20.90 per share as of March 8th, 2023. This is lower than the stock’s high point of $25.60 per share in September 2022 but higher than its low point of $16.70 in December 2022.

Despite the fluctuations in the stock price, IGT has received an average rating of “Buy” from ten Wall Street analysts who cover the stock. The consensus price target for IGT is $27.00 per share.

IGT’s Q4 2022 results show a positive trend in revenue and profitability. While the stock price has experienced volatility, Wall Street analysts maintain a positive outlook with an average “Buy” rating and a consensus price target of $27.00 per share.

IGT Poised for Upside Potential with Strong Financials and Growth Story

International Game Technology (IGT) is a multinational gambling company that produces slot machines and other gambling technology, providing gaming machines, lottery systems, and sports betting services worldwide. Headquartered in London, IGT has principal offices in Rome, Providence, Rhode Island, and Las Vegas. The company’s products consist of slot machines and social gaming platforms, and it has significant operations outside the US.

Despite trading at a discount to its peers, Wall Street analysts see upside potential in IGT, with shares potentially worth 50% more at a multiple in line with its peers. The company has a credible growth story backed by strong financials, including a high FCF yield. Investors will want IGT’s growth in ROCE to persist. In Q3 2022 earnings report, the company beat expectations and updated FY22 guidance.

In March 2022, IGT’s subsidiary, IGT global services, announced a 6-year partnership agreement with Singapore Pools Limited. In April 2022, IGT announced its deal to acquire iGaming content provider iSoftBet for approximately…

As of March 8th, 2023, IGT’s stock price is $15.20 per share, trading at a discount to its peers. However, Wall Street analysts have provided an average price target of $23.00, with the highest price target at $25.00 and the lowest at $21.00. Investors should consider the potential upside of IGT’s credible growth story backed by solid financials when evaluating whether or not to invest in the company.

IGT Leads the Way in Global Gaming with Strong Financial Performance

International Game Technology (IGT) operates in over 100 countries worldwide and deals with different ethnicities and nations with varying levels of regulation. IGT has seamlessly transitioned to the web-based side of gaming, offering players their favorite games across various channels and regulated markets, from gaming machines to sports betting.

In 2022, IGT achieved all its financial goals while strengthening its leadership positions across its Global Lottery, Global Gaming, and Sports Betting businesses. The company generated strong cash flow while increasing product investments, resulting in significantly improved earnings power, as demonstrated by its adjusted EPS. With reduced interest expenses and improvements to the effective tax rate, IGT’s financial performance is a testament to the strength of its business model.

IGT is uniquely positioned to provide regulated gaming services as player demand grows worldwide and governments need funding. The company offers the industry’s most significant number of game themes, with a vast library of titles and game types targeting specific player segments. IGT is also known for its attention to detail and outstanding design, as well as its free spins and generous welcome bonuses.

As the global leader in gaming, IGT delivers entertaining and responsible gaming experiences, from Gaming Machines and Lotteries to Sports Betting. The company has demonstrated leadership in global sustainability by providing globally trusted solutions for exclusive content and platform innovation.

IGT’s strong financial performance and global leadership position in gaming make it an attractive investment opportunity. With a vast library of game themes, attention to detail, and outstanding design, IGT is poised for continued success in the gaming industry.