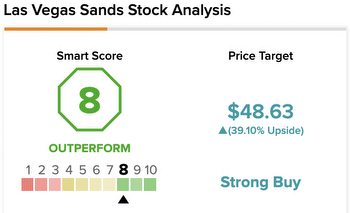

Las Vegas Sands Eyes New York, Texas, Florida Casinos

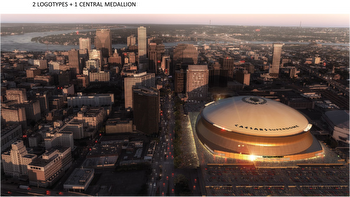

Las Vegas Sands is considering a return to the American market. Sands are considering New York, Texas and Florida.

Las Vegas Sands Corporation is considering new development projects in New York, Texas and Florida. LVS closed a deal on February 23 to sell The Venetian, Palazzo and the Venenetians Expo Center for $6.25bn. Marina Bay Sands in Singapore has been the company's top grosser.

LVS reported $943m in net revenue, down from 2021’s first-quarter total of $1.2bn. The operation loss grew to $302m from $96m the year prior. Overall net loss from operations ballooned to $478m compared to 2021's first quarter. Property earnings before interest, taxes, depreciation, and amortization (EBITDA) were $110m, up more than 45% from last year's sum. Marina Bay Sands individually reported a positive EBITda.

February's sale of LVS' Vegas properties was done to fund future developments. LVMV's focus is to build large-scale operating facilities. They are not interested in more reserved regional locations. Florida's gambling restrictions limit potential building sites. LMSV is confident it will return to positive cash flow in Singapore and Macau in the future. It is in a positive beginning in Asia and has a bright future ahead of it.