The Day After the Fed Meeting, I'm Gambling on This Stock

The Fed interest rate decision and Chair Jerome Powell's comments on Wednesday caused a change in the market narrative and shifted the character of the price action. The bulls have been very optimistic that the Fed is near the end of its hiking campaign, which would be the catalyst for sustained market upside.

The Fed is nearly done hiking, but that is not the great positive the bulls hoped for. There is still the potential for one more hike, but what is most important now is that the Fed is signaling that rate cuts won't occur anytime soon. There is also a lack of clarity about the potential for a recession. Yes, the Fed has done a good job with inflation, but the bulls have been too optimistic about it, and now they have to reset, and the market is under pressure as it is trying to discount this shift.

The good news is that many stocks are pulling back and will eventually offer some good entry points, but it is likely too early to be aggressive at this point.

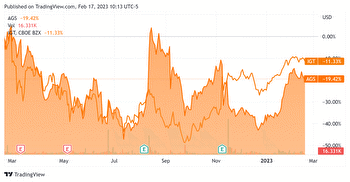

One small cap that I've been following for a while has pulled back to a support level that I like, and I am adding some shares today. That stock is Gambling.com Group (GAMB) .

Bob Lang recently mentioned gambling play DraftKings (DKNG) as a favorite into the end of the year. He provides some good reasons to like the potential growth in the gaming sector, which is why I like GAMB.

Gambling.com Group is a media and performance marketing company focused on the gambling industry. It offers informational portals that compare and review regulated online gambling websites worldwide. It is a media company and, unlike DKNG, does not offer actual gambling services. It helps online sportsbooks and casino operators acquire players. GAMB is paid when it performs by delivering new betting customers to various betting sites.

The sports betting and gambling industry is becoming increasingly competitive, but it is estimated that online gambling will grow from around $105 billion currently to $213 billion within the next five years. Companies like Draftkings, Inc. will have to compete heavily, while GAMB has more leverage to overall growth in the gambling market.

GAMB issued a very strong second-quarter earnings report on Aug. 17. North American revenues rose 115%, and overall revenues rose 63%. The company is anticipating additional growth as states like North Carolina and Kentucky come online for sports betting. It also uses its business model internationally.

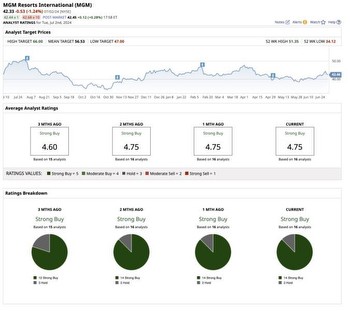

Current estimates for 2023 and 2024 are $0.54 and $0.88, respectively, which reflects growth of 63%. The current trailing price-to-earnings is 55. Eight analysts are following the stock, and they all have buy ratings with targets from $13 to $17. The average is $15.29, and the stock is currently trading at around $13.30.