Gambling.com (NASDAQ:GAMB): A Strong Bet in the Online Gaming Market

The thriving online gambling industry, especially in the U.S., holds immense potential for expansion. With its recently robust financial performance, Gambling.com (NASDAQ:GAMB) has shown it is in an excellent position to leverage these opportunities. The stock is worth serious consideration for growth investors looking at players in the gambling space.

Positioned to Take Advantage of Industry Growth

Gambling.com provides digital marketing services within the online gambling industry, specifically geared towards iGaming and sports betting. As a performance marketing company, its business model involves generating income through referring online gamblers to various online gambling operators. Operating globally, it also caters to the iGaming and social casino product market while running multiple branded websites, including Gambling.com, Casinos.com, RotoWire.com, and Bookies.com.

The online gambling industry, particularly sports betting in the U.S., has seen significant growth following the 2018 U.S. Supreme Court decision that overturned the federal ban on sports betting. This ruling prompted more than 30 states, plus the District of Columbia, to legalize some formats of sports betting, the majority of which also permit online bets. An additional 10 states are anticipated to follow suit in the near future.

Data from Statista predicts continued expansion in this industry, projecting that revenue in the Online Gambling market could rise to approximately $35.21 billion by 2029, a CAGR (compound annual growth rate) of 8.86%.

Recent News Driving GAMB Stock

Gambling.com recently reported solid financial performance for Q4 2023, with a 52% rise in revenue to $32.53 million exceeding the $27.69 million consensus. This increase contributed to a 42% growth in annual revenue for the year, totaling about $108.7 million. However, the Q4 adjusted EPS of $0.18 slightly missed the consensus expectation of $0.19, though it significantly increased from $0.02 in the prior-year quarter.

Looking to 2024, management forecasts revenue between $129 million and $133 million, surpassing the consensus of $120.61 million. It also expects an adjusted EBITDA between $44 million and $48 million. In addition, the company has disclosed plans to acquire Freebets.com to broaden its reach in the United Kingdom and other European markets. The purchase, set to close in early April, is projected to generate approximately $10 million in revenue and $5 million in incremental adjusted EBITDA from April to December 2024.

To fund potential growth opportunities, Gambling.com has secured a new credit facility with Wells Fargo Bank totaling $50 million. This consists of a $25 million revolving credit facility and a $25 million term loan facility maturing in March 2027. With approval from Wells Fargo, the credit facility may be incrementally increased by up to $10 million.

What is the Price Target for GAMB?

After a slow start to the year, GAMB stock has picked up some momentum and is up 2.82% over the past 30 days, though it still sits toward the low end of its 52-week price range of $8.39-$14.83. From a valuation perspective, the stock appears to be fairly valued based on relative metrics. The P/E (19.4x) and P/S (3.25x) ratios are roughly in line with the Gambling industry averages (P/E 20.8x and P/S 3.0x).

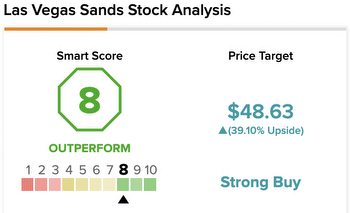

Analysts have been bullish on Gambling.com stock. For example, Jefferies analyst David Katz recently reiterated a Buy rating and set a price target of $18, citing solid fundamentals and strategic initiatives anticipated to propel the company in the next financial year.

The stock is rated a Strong Buy based on bullish reviews from six analysts in the last 3 months. The average price target for GAMB is $15.25, which represents 67.03% upside from current levels.

The Over/Under on GAMB

The thriving U.S. online gambling industry has witnessed significant growth and holds substantial potential for further expansion. Gambling.com has shown strong financial performance and demonstrated its ability to capitalize on these opportunities with its unique business model.

With acquisitions in the pipeline and a war chest lined up for more, the currently fair valuation may, in fact, turn out to be an undervalue if forward earnings grow faster than anticipated, making GAMB stock an intriguing prospect for growth-focused investors.