New York Developer Gambles on Las Vegas Shift Toward Strip-Facing Stores

Eli Gindi’s Latest Project Bets on Lift From Sports Arenas and the Gaming District’s South End

More than ever, new retail space being added off the Las Vegas Strip is bursting out onto the street.

Stores on Las Vegas Boulevard, the famous 4-mile-long bustling corridor in the U.S. gambling capital, have traditionally been ensconced indoors in air-conditioned casino hotels or within a handful of enclosed malls. But two new projects, one under construction and the otherrecently opened, are bringing a new type of so-called street-facing retail to the Nevada city's resort corridor.

“The rarity is door-to-the-street" retail on the Strip, Frank Volk, a CBRE executive vice president, told CoStar News.

But now New York developer Eli Gindi, whose family founded and owned the Century 21 off-price fashion chain, has the biggest bet going on street-facing retail in Las Vegas with a property called BLVD. Gindi, who refers to the Strip as "Times Square West," has started work on a new project at 3743 S Las Vegas Blvd. The 300,000-square-foot project is designed with two stories of retail space topped by a 100,000-square-foot rooftop dining and social hangout area overlooking the Strip.

There is also new street-level retail on a smaller scale that recently opened, Project 63at Harmon Avenue and Las Vegas Boulevard. That roughly 186,000-square-foot complex is located right next to Simon Property Group's upscale The Shops at Crystals, an enclosed mall developed by Torino Cos. of Las Vegas and New York-based Flag Luxury Properties.

Those new retail projects on the south end of the Strip reflect the change the area has seen in recent years. Las Vegas is evolving beyond a gambling and entertainment mecca to also become a sports hub, with relatively new pro venues — such as T-Mobile Arena, home of Golden Knights hockey, andAllegiant Stadium, home offootball's Raiders — already open and luring potential customers for nearby stores.

And more stadiums are expected to be added in the southern part of town. The Oakland Athletics baseball team plans to relocate to Las Vegas from California and build a stadium at the site of the Tropicana Hotel. The city is also set to be hosting a Formula 1 race in November, which could become an annually recurring event. The Super Bowl is scheduled to be played at Allegiant Stadium in February.

But all that extra development can also mean additional competition, making it more difficult to get the numbers to work out profitably.

Even so, for years now, Gindi has been snapping up retail properties on the southern part of the Strip, investing hundreds of millions of dollars. As such, he's been instrumental in reshaping and reimagining that area. BLVD's marketing brochure points out that the property is just an eight-minute walk from T-Mobile Arena.

"What had been sort of the fringe of the Strip has now become the center of the Strip," Michael Hirschfeld, a JLL vice chairman who is handling leasing for BLVD, told CoStar News. “To say it’s the center of the new Vegas is a fair statement.”

Gindi isn't the only one rolling the dice on the south end of the Strip. Houston billionaire Tilman Fertitta paid $270 million last year for a 6.2-acre property directly north of Gindi’s BLVD site. Fertitta has proposed a 43-story resort hotel, The Post Oak, with 2,420 guest rooms, a casino, a spa, a convention center, and a concert space with seating for 2,500 people.

And while BLVD and Project 63 are seeking traditional retail tenants, they are also actively searching for the new breed of tenants that provide experiences for customers with interactive features. For example, the Museum of Illusions, part of a chain of magic venues, is a tenant at Project 63, which Volk represents. And in the wake of the pandemic, outdoor terrace and rooftop dining options are becoming in vogue on the Strip, despite the sun and heat in Nevada. BLVD will include a large outdoor third floor, while OceanPrime, a$20 million restaurant that debuted in June at Project 63, has a 2,500-square-foot rooftop terrace.

The brokers marketing these projects, Hirschfeld and Volk, are upbeat about the projects' prospects of drawing shoppers and diners, in part by saying that Las Vegas tourism has rebounded and the gaming hub has proved its resilience withstanding COVID-19. The city now draws 42 million annual visitors, and BLVD's location sees about 75,000 pedestrians daily.

But Las Vegas is a very competitive market when it comes to retail and dining, with a vast selection of upscale stores and top-notch restaurants to choose from, and that's what BLVD and 63 are up against, according to Minjia Yan, a director at Millennium Commercial Properties in Las Vegas. Some visitors may prefer the convenience of shopping and eating at their casino hotels rather than venturing out on the Strip, Yan told CoStar News.

Las Vegas is also littered with real estate developments that failed or went bankrupt, Yan said. Project 63 was built on the site of a hotel-and-condo project, The Harmon, that never opened.

Even if a retail center attracts lots of customers, its financial model in terms of costs and other factors has to work, Yan added.

"When you have 43 million people coming every year, there's always something for everybody," Yan said. "The traffic is there. You don't need anything else to prove this is a busy town, a busy strip. I think it just comes down to the land price, the revenue model" for a project.

Gindi is a risk-taker who has had an eclectic career and owns a varied real estate portfolio. He was involved in his family's business, Century 21, making him what he called a "garmento" — New York slang for someone involved in Manhattan's fashion industry — for two decades. He also co-founded his current company, Gindi Capital, and has invested in real estate around the country.

In 2013, he andthe Nakash family, the founders of Jordache jeans, acquired the Miami Beach, Florida, mansion of fashion designer Gianni Versace, who was fatally shot on the home's steps in 1997. They paid $41 million to outbid Donald Trump for the property, which now operates as a boutique hotel and restaurant.

Gindi declined to be interviewed by CoStar News. But at this year's ICSC conference in May in Las Vegas, he talked about how and why he began investing in retail real estate on the Strip in a podcast with James Cook, JLL Americas director of retail research. The name of that particular podcast was "This Is Times Square 1970," reflecting Gindi's belief that investing in retail property on the Strip presents an opportunity similar to the one that existed prior to the transformation of that once-blighted Manhattan neighborhood.

On a visit to Las Vegas in 2013 with his business partner, Joe Nakash, Gindhi went to the Showcase Mall, which had not only such tenants as M&M's and Coca-Cola, but also tattoo parlors and margarita stands, and the "seediest stores you ever saw in your life,” Gindhi said on the podcast. He said he was undaunted because he saw so many people were walking around.

“I said I’m not leaving until we buy it," Gindi told his partner, adding "look at the people. Look at the traffic. We just have to clean up these stores.”

Gindi "was definitely early on in perceiving" the opportunities for "street retail in Vegas," Hirschfeld said, adding, "street-facing retail development, only retail — no hotel, no gaming — was sort of like, wow.”

The broker described the Strip at that time, by the Showcase, "other than Coca-Cola and M&M's, as pretty gritty, I guess is the way I would call it. It was not the part of Vegas that you necessarily wanted to be in.”

In July 2014, Gindi and the Nakash family acquired the original center area of the Showcase for $145 million, then the northern part for $139.5 million in January 2015. After fully consolidating their ownership later that year by acquiring the last portion of the property for $82.9 million, they then went about upgrading the tenant roster.

Gindi wasn't through buying retail on the Strip, however. In 2017, heand the Nakash familypaid $59.5 million for the site of a Smith & Wollensky steakhouse north of the Showcase that they redeveloped into 150,000-square-foot retail centerthat now houses Target and Burlington stores,a rooftopBrewDog brew pub, an Olive Garden, and a hands-on entertainment Paradox Museum, which is part of a growing chain.

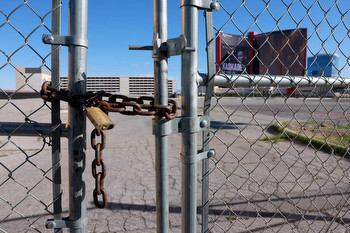

But down south on the Strip from the revamped Showcase was another outdated and underdeveloped retail center, called the Hawaiian Marketplace.

Gindi partnered with Andrew Cherng, co-founder and co-CEO of thePanda Express restaurant chain, to buy the Hawaiian Marketplace, a 9.5-acre site, for $172.3million in 2019. The pandemic held up their plans for redeveloping the property, but now the old buildings have been demolished to make way for BLVD. There were tours of the site during this year's ICSC conference, and officials are hoping BLVD will be open in the first or second quarter of 2025 in time for the annual retail industry conference that year.

“It’s such a unique property," Gindi said on the JLL podcast. "It's opposite the Cosmopolitan [hotel]. It’s opposite the Crystals shops. I’m not going for those high-end tenants. I want to get those athletic tenants. You've got the Raiders stadium right there. You've got Golden Knights, and now the baseball stadium is coming. ... This is a great city, a great sports town.”

Cherng owns the Waldorf Astoria Las Vegas, which is located at CityCenter, a cluster of hospitality and retail properties that includes Project 63 as well as The Shops at Crystals, and the Aria and Vdara hotels. The Cosmopolitan, which is owned by Cherng along with Blackstone Group and Stonepeak Partners, is located next to Project 63. The Miracle Mile Shops at Planet Hollywood, a mall, is also in that part of the city.

Only one place has more foot traffic than the Strip, and that's Times Square, "but rents in Times Square are also six times what rents are on Las Vegas Boulevard," Hirschfeld said.

BLVD has several signed leases, including one with Puma for a 20,000-square-foot, two-story flagship store, he said. Another global brand will be taking a three-level, 25,000-square-foot space, according to the broker, who declined to identify that tenant.

The project's most interesting feature is that it has 700 feet of retail space directly fronting the Strip and roughly 55-foot, two-story storefront heights.

“When you take a retail space at the BLVD, your storefront is 55 feet high," Hirschfeld said. "Whether you take one floor or two floors, you still get a double-height storefront. So between the number of people who walk by, the number of people who drive by, you are getting hundreds of millions of eyeballs on your store every year.”

BLVD's rents hinge on how much street frontage a retailer wants rather than the depth of its store, or $60,000 per front-foot space, according to Hirschfeld. So someone leasing a space with 50 feet facing the street will pay $3 million annually, he said. Stores can go a maximum of 200 feet deep. If a tenant wants a 50-foot-long storefront that’s just 100 feet deep, it will pay the same rent as if it was occupying a space that was 200 feet deep, according to Hirschfeld.

BLVD will have 40,000 hotel rooms looking down on it, according to Mark Welz, a principal of 5+design, the project's architect.

“We didn’t want to create a vertical shopping mall,” he told CoStar News and BLVD's rooftop area is meant to serve as a public plaza where people can go to dine or have drinks after a sporting event, for example.

Torino and Flag Luxury acquired the site of Project 63 for $80 million in 2021. The four-story center, which is topped by a large LED billboard on its exterior, opens directly onto the bridges that take pedestrians to other CityCenter attractions, like the Miracle Mile mall. Project 63 is nearly fully leased.

“It’s street retail," Volk said. "It’s not a mall. You’ve got 50-some-odd-thousand people a day walking on the bridges. And we kind of merchandise to those people. Crystals is amazing, but 95% of the people walking around can’t afford anything there.”

The arrival of the Oakland A’s and their stadium is expected to further add to the visitor count, Volk said, echoing others.

The developers of Project 63, Torino and Flag Luxury, didn't return emails from CoStar News seeking a comment.

The tenant roster at Project 63 includes the newly opened Ocean Prime eatery, a Ross Dress for Less store, a Fat Tuesday restaurant, the experiential Museum of Illusions, and a Welcome to Las Vegas gift shop.

In the CityCenter area, Volk said Miracle Mile, which is roughly 503,000 square feet, has undertaken a major update. It's another sign of the growing success and confidence in the Strip's south end. Those renovations include new flooring, lighting and ceilings; state-of-the-art LED screens; upgrades to the mall's Rain Show; and new tenants Rosa Mexicano, a restaurant, and Sandbox VR, an immersive virtual reality experience. The owners of Miracle Mile — Miller Capital Advisory and the California Public Employees’ Retirement System, known as CalPERS — recently refinanced the property, obtaining a $425 million commercial mortgage loan.

The retail vacancy rate for the resort corridor, basically the Strip, is 4.1%, lower than the vacancy rate for the larger Las Vegas metropolitan region at 5.2%, according to CoStar data. Retail annual rent growth is 9.9% for the resort corridor, compared with 7.8% for the market at large, according to CoStar. The existing and coming sports arenas should be a boost.

"The south end of the Strip already boasts T-Mobile Arena but having an MLB stadium located on Las Vegas Boulevard will drastically change the landscape," Michael Petrivelli, a CoStar market analyst, said in an email. "Compared to the main drag, the south end has more potential sites for development, particularly between Las Vegas Boulevard and the airport."

And street-facing retail has what's needed to succeed, according to Petrivelli.

"As long as tailwinds from tourism and convention attendance can maintain momentum in an uncertain economic environment, street-level retail is well-positioned to capitalize," he said. "Major upcoming events such as TwitchCon, Formula 1 and the Super Bowl could drive new records of visitor traffic in the coming months. Additionally, with most retail locations concentrated within casinos and hotels, street-level access is a novelty that should attract consumers walking along bustling Las Vegas Boulevard."

Millennium's Yan said the influx of investment from New York has resulted in the new trend of street-retail stores not linked to casinos or hospitality on the Strip. The older Las Vegas hotels "were built by Vegas developers who want you to go through the casino ... the original entrepreneurs that built Vegas," according to Yan.

"So the new properties like 63 or the BLVD and the Target, those are done by New York capital, New York developers," she said. "In New York, Manhattan, you walk in [a store] and there's no casino. Because of the change in the developers, they created different products because of their backgrounds. Their experience, their expertise are different."

In the case of Gindi, his timing for BLVD was right, according to Hirschfeld, pointing out the portion of the Strip bracketed by thePost Oak hotel, Cosmopolitan and CityCenter on the north, and sports stadiums to the south.

"So whether it's by design or dumb luck, you know what, Eli read it correctly and he backed it with hundreds of millions of dollars,” Hirschfeld said.