Lawmakers in India Consider Imposing 28% Tax On Online Gambling

Image Source: Shutterstock.com

The growing gambling industry in India may be subject to a new, increased tax rate, following a decision made by lawmakers Tuesday. The country’s Goods and Service Tax Council, the regulatory body in charge of recommendations to the implementation of the Goods and Services Tax (GST) confirmed it has agreed to the implementation of a 28% goods and service tax, applicable for horseracing, casinos, as well as online gambling activities.

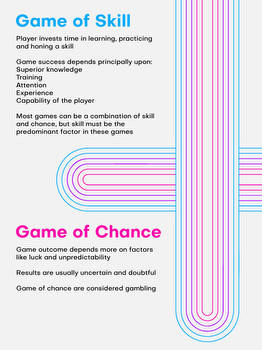

The decision will see the addition of gambling activities to the GST and is expected to be levied on the full value of the chips that are purchased by the customers or the bet they have made. Additionally, the new increased tax will affect not only chance-based games but skill-based games as well.

According to Nirmala Sitharaman, India’s Finance Minister that serves as a chair of the Goods and Services Tax Council, the implementation of the new tax follows a prolonged review process and debate. He outlined that the tax will be implemented with the addition of gambling activities, including horseracing and online gambling to the GST Act.

In addition to the increase in tax for gambling activities, the Goods and Service Tax Council confirmed it has decided to cut the taxes for drinks and foods that cinema visitors can purchase. The tax rate for those products was reduced from 18% to 5%.

The Tax May Have a Devastating Impact on the Gambling Sector

The government’s decision for the new gambling tax immediately caught the attention of companies and organizations within the sector that harshly criticized the new levy and warned that it may have a devastating impact on the industry in the country. The flourishing gambling sector in India is valued at $1.5 billion and has helped attract hundreds of millions of investments.

The gambling sector warned that the potential increase in the tax may have a devastating impact on the industry, resulting in job losses, losing investments and directing customers to the black market.

“We believe this decision by the GST Council is unconstitutional, irrational and egregious.“

Roland Landers, CEO of The All India Gaming Federation

Roland Landers, The All India Gaming Federation’s CEO, who was cited by Deccan Herald, criticized the Council’s decision claiming that the increased tax is irrational and against the constitution. “The decision ignores over 60 years of settled legal jurisprudence and lumps online skill gaming with gambling activities,” he said. Additionally, Landers warned that the increased tax may result in hundreds of thousands of lost jobs and predicted that only illegal offshore operators will benefit from the change.

Ankur Gupta, a practice Leader of indirect tax at SW India, was similarly concerned about the new levy. He predicted that the new 28% tax rate on the gambling sector will be a major “setback for Indian players.” In that line of thought, it is yet to be confirmed if lawmakers will make further changes in light of the industry’s outlash.

Jerome is a welcome new addition to the Gambling News team, bringing years of journalistic experience within the iGaming sector. His interest in the industry begun after he graduated from college where he played in regular local poker tournaments which eventually lead to exposure towards the growing popularity of online poker and casino rooms. Jerome now puts all the knowledge he's accrued to fuel his passion for journalism, providing our team with the latest scoops online.