GST fail to reach a consensus on online gambling and gaming in India

A proposed blanket tax rate of 28% on goods and services could severely hamper the booming gaming and gambling sector in India. This rate hike on Goods and Services Tax (GST) would be applicable to all types of online gaming. Currently, the GST is 18%, and an increase to 28% is believed to make it unviable for many companies to conduct business in India. If the blanket tax would be applicable to all actors within the online gambling sector, it would be more viable. But as it stands today, foreign operators are dominating the sector, often operating out of tax havens. This is something that creates unfair market conditions for potential domestic operators.

Recently, the GST Council tasked a panel of ministers, led by Meghalaya Chief Minister Conrad Sangma, to examine the taxation scheme for online gambling in India. The panel recently completed their examination, and the results were not favourable for the online gambling and gaming industry. The panel suggested a 28% blanket tax rate, up from the current 18%. Something that created a backlash from the industry, with many companies lobbying to influence the legislators. Following discussions, the panel from GST has agreed to further deliberations on the matter. The target date to finalize the revised report was set for August 10, but due to divided opinions, it was postponed. The latest news indicates it should be submitted soon and discussed during the GST Council meeting scheduled for December 17, 2022.

Heavy backlash

The proposal received backlash quickly as many industry experts said that the increase would stifle growth within India. At the same time, the changes would encourage offshore online casino operators to offer services while circumventing the tax jurisdiction. This would create unfavourable conditions where Indian operators lose out, the government would lose out on tax revenues due to companies going out of business, and players would be at risk of being exposed to dishonest offshore operators.

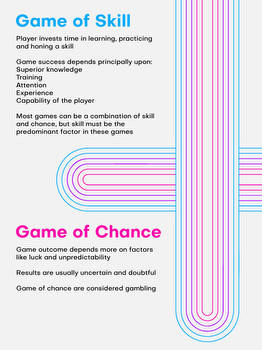

Furthermore, another controversy was sparked around distinctions between fantasy games, online poker, and online rummy. There is an important distinction between lottery games, online slots, and the games outlined above. The former belongs to the category of ‘game of skill’, while the latter belongs to ‘game of chance’. In most tax jurisdictions and even legal jurisdictions across the world, lawmakers and policymakers make clear distinctions between the two. Where laws and taxes for the different types of games are handled differently. The reasoning behind this is that games that are ‘game of skill’ requires the player to have skills which play a part in the outcome of a game. A person that buys a lottery ticker or spins for the jackpot in an online slot is relying solely on luck. The panel that was tasked by the GST Council made no such distinctions and instead proposed a 28% tax rate on all of these gaming activities, regardless if a game falls within the purview of betting or gambling.

Bad from all perspectives

The current state of online gambling in India makes it possible for offshore operators to provide service to Indian residents. Naturally, offshore operators are not subject to Indian tax jurisdiction. Instead, they are subject to the tax jurisdiction of the country they are situated in. More often than not, these foreign online gambling companies conduct business from jurisdictions with extremely favourable tax rates. As an example, a popular destination for these companies is the island of Malta, located in Europe. Companies in Malta need to pay 35% in corporate taxes but can enjoy tax returns up to 6/7, effectively lowering the tax to 5%. If India passes a law that makes it possible for online gambling operators to operate with licences from within the country, there will still be an unfair competitive advantage for foreign operators. Given that Indian companies would be subject to 28% tax while foreign competition may be taxed as low a 5%. In addition to a new tax regime, the Indian government would have to limit the impact that foreign companies have on the Indian market.

Besides the fact that Indian operators would be at a disadvantage, the government would lose out on even more tax revenues, while the offshore companies would be generating more tax revenues for the respective countries they are situated in.

Besides the threat to the economy of India and the unfair playing field, there are also concerns for player safety. Over the years, there have been many instances of offshore operators indulging in fraudulent activities. Games are manipulated to cheat players, and there are many reports of unfair websites refusing players to withdraw winnings under the pretext of dubious terms and conditions. This creates both financial and social risks for Indian consumers. It is also an unsustainable situation as there is no way for Indian authorities to assist since the offshore companies are outside their jurisdiction.

Failed to reach consensus

Following the initial report and the industry backlash, the panel appointed by the GST Council failed to reach a consensus. After a virtual meeting between ministers on July 12, the panel felt that further examinations and discussions were required on the matter. August 10 is the target date for the panel to submit a revised report. This date makes it likely that the report will be taken up for discussion in the GST Council meeting in Madurai scheduled for next month.

It has been stated by officials that further detailing is needed to understand why ‘game of skill’ and ‘game of chance’ require different treatment. There are also discussions about different treatments of games that are categorized as ‘game of chance’. The final details are coming, and before the GST Council can give final approval to the recommendations, a consensus needs to be reached.