India introduces 28% tax on online gambling sector

Since last July, the government of India has announced its intention to levy a 28 percent tax on funds collected by online gaming companies from their customers. The decision could be considered to become a significant blow to the thriving online gaming sector in India.

This decision has also sent shockwaves throughout the gaming community. The 28 percent tax raised concerns about the potential repercussions for players and businesses. It becomes even more serious considering the gaming sector is a $1.5 billion industry.

While gaming apps have gained immense popularity in India, there are concerns about the possibility of addiction and financial losses. Gaming apps are often endorsed by iconic sporting figures in a nation where cricket holds a position of national passion.

While the online gaming sector has enjoyed solid growth, the government's decision to impose a hefty tax could disrupt this trajectory. International investors, recognizing the potential of the Indian gaming market, have also shown their interest.

Finance Minister Nirmala Sitharaman revealed the decision to tax online gaming following extensive discussions. Sitharaman, leading the tax council, mentioned insiders worry the tax could make gaming companies raise prices for customers.

Garners criticism from many experts

The imposition of a 28 percent tax on online gaming in India has evoked strong reactions from experts who view it as a potential "existential threat" to the industry. Shares of Indian online gaming platforms and casinos have plummeted in the wake of the decision made by the GST (Goods and Services Tax) Council.

The ramifications of this decision could be far-reaching, impacting not only player engagement and revenue but also investor sentiment. With the imposition of a 28 percent GST on the full value of gaming transactions, the industry anticipates a significant shift in taxation dynamics. As a result, for every $100 spent by a player, a $28 GST charge, platform fees, and a 30 percent tax deduction on winnings could lead to an overall tax collection of over 50 percent, including various other charges.

Sudipta Bhattacharjee, a partner at corporate law firm Khaitan & Co., highlighted that this move deviates from global standards where VAT or GST is typically applied to platform fees or commissions only. He expressed concern that such a tax structure could discourage players and harm investor confidence, potentially leading to a slowdown in funding.

Aaditya Shah, Chief Operating Officer at the gaming app IndiaPlays, highlighted the potential challenges the 28 percent tax rate could bring to the industry. He emphasized that the elevated tax burden could significantly impact companies' cash flows in the sector.

Roland Landers, CEO of The All India Gaming Federation, also strongly criticized the decision. Landers deemed it "unconstitutional [and] irrational." This sentiment was echoed by Kishore Kumar, indirect tax lead at Taxmann. Kumar argued the proposal would effectively classify skill-based games as gambling and betting activities, blurring the distinction between the two.

In the context of online gaming, the popular fantasy cricket games offered by platforms have garnered immense attention. Players can form their teams for a chance to win from a total prize pool of millions of rupees.

Previously, companies in the sector were subject to a small tax on the fees charged for real money games. However, the recent change dictates that a 28 percent tax will now apply to the entire amount collected from players in each game.

During the recent Indian Premier League cricket matches, fantasy gaming platforms earned over $342 million with 61 million participants, a 24% increase from the previous year, as per Redseer consultancy.

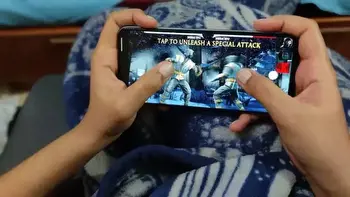

While India's online gaming industry has experienced substantial growth in recent years, driven by factors such as affordable smartphones and accessible mobile data, a 28 percent tax poses new challenges. Startups in the industry are now confronted with the need to reconsider their strategies, potentially even relocating their operations outside of India to mitigate the impact on investors.

Gaurav Gaggar, the Promoter of Poker High, a poker site, minced no words in his criticism of the decision. He declared that the industry had been dealt a severe blow and expressed concerns that it could pave the way for the growth of illegal and unauthorized operators within the country.

The All India Gaming Federation joined the chorus of criticism, deeming the government's decision "unconstitutional, irrational, and egregious." The federation argued that the government's approach contradicted decades of established legal principles that had kept online skill-based gaming distinct from gambling.

Amidst these discussions, it is worth noting that the gaming landscape is rapidly evolving with many innovations. Modern concepts like SRL betting, crypto crash games, and live table games are reshaping the industry. Policymakers need to consider these emerging trends and ensure that regulations are adaptive and forward-looking.

Disclaimer: The above is a sponsored article and the views expressed are those of the sponsor/author and do not represent the stand and views of The Tribune editorial in any manner.