Fair GST implementation on skill-based online games could reshape the Indian online gaming sector

The Indian online gaming industry has been flourishing in the past few years. The industry awaits a clear judgment on GST restructuring and rate rationalisations on the online games. A new GoM was formed earlier in February 2022 to make recommendations on a GST rate. The previous Gom was dissolved last year in May.

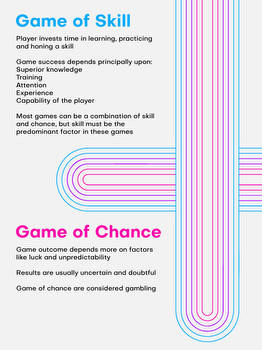

The Indian online gaming industry has been flourishing in the past few years. The industry awaits a clear judgment on GST restructuring and rate rationalisations on the online games. Currently, services provided by online skill gaming platforms are subjected to 18% GST on gross gaming revenue (GGR) whereas, the games of chance attract 28%. In most games, average ticket size is between Rs. 25 and 35. In real-money games players have to pay an entry fee to join a gaming tournament and the total amount collected is called the prize pool money. Different companies deal with different models of holding the money and some could choose to hold the revenue in a separate electronic ledger.

GST implementation on skill-based online games could reshape the Indian online gaming sector.