Las Vegas Sands: Capitulation Here Or Near

Sheldon G. Adelson built Las Vegas Sands from the ruins of failed casinos. He sold the entire Vegas asset base for $6.2 billion in 2021. The proceeds will be used for a third Asian IR and a bid for metro New York based mega-project. LVS clocked $12 billion revenue in pre-pandemic years. Before the 2020 pandemic, the stock was trading as high as $80. L VS is the biggest casino operator on the globe. It is planning to expand into online sports and iGaming. Its shares are trading at $8.

Dr. Miriam Adelson is in control of the trust holding majority shares of Las Vegas Sands. She shares her husband's vision for the development of new markets. Robert Goldstein's successor assured investors that LVS is on the trail of these new vistas. He saw a deal to build and develop a third Asian property in Thailand. L VS is also interested in buying a significant chunk of equity of an online gaming operator.

Las Vegas Sands is facing uncertain economic conditions in Macau. Singapore is recovering and is making a contribution to LVS' revenue. LBS is still cash-strapped in the online sports betting sector. The company has a disciplined approach to asset allocation. There are no catalysts outside of positive news from Macao that could move the stock ahead.

The uncertainties of China's zero tolerance policy affected gambling in Macau and outbound tourism from China. LVS' Macao properties are valued even now at 7X cash flow. The market didn't buy the "wait it out" scenario. The shares moved sideways. Las Vegas Sands is in good shape unless there is a black swan swimming to crap all over the entire sector again. It's not clear if the company will be able to survive. There is an opportunity for the market to take a risk. If it does, it will take the stock. I was wrong in assessing what I believed to be an Adelson's like decision process.

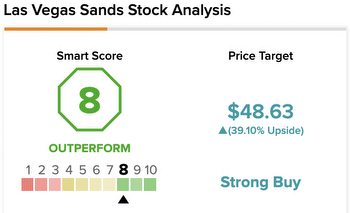

Dr. Adelson is no longer involved in Las Vegas Sands. The company is valued at $38.97 a share. It has a market cap of $29.5 billion. LVS has $6.4 billion in cash and an analyst consensus PT of $46.77. LVMH is $30.7 billion, but the market is undervaluing the company.

According to Alpha spread analysis, the DCF base case value of Las Vegas Sands is $49.25. However, it's undervalued by 21%. The future China revenue flows are the core issue of the stock. If and when the company's China revenues improve, LVS will respond aggressively.