I'm 92 years old and just won $434,105 playing the Fast Cash lottery game

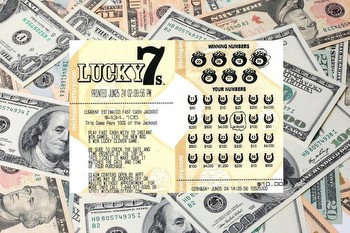

A LUCKY 92-year-old player in Michigan won the $434,105 fast cash jackpot.

The winner, who chose to remain anonymous, bought the lottery ticket on June 25, 2024.

He bought it at a Sunoco gas station in Lansing, about 82 miles northwest of Detroit.

He said he decided to go after the jackpot when he saw it was on the rise.

“I stopped into a store and said: ‘I’m going after that jackpot!’ I bought two tickets and didn’t win, so I stopped into a different store later that day and purchased two more tickets," he said.

Then he won the Lucky 7s Fast Cash progressive jackpot.

“I won $50 on one, and on the other I matched number ‘59’ with ‘Jackpot’ underneath. I knew what I was seeing, but I scanned the ticket to be sure," he said.

"When a message came up to file a claim at the Lottery office, I knew that I’d really won the jackpot!”

Authorities said the player has recently visited the Lottery headquarters to claim the prize.

He said he would share his winnings with his family.

HOW TO PLAY A FAST CASH GAME

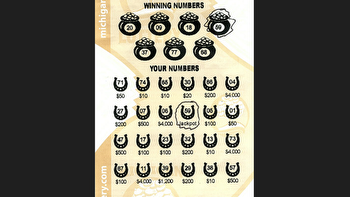

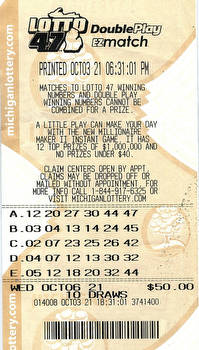

Fast Cash games are instant-win games.

To play, a player has to match any of the winning numbers.

Lottery winner takes home $500,000 Powerball prize after phone call – but he was forced to give up nearly half

Depending on the game, each ticket costs between $2 to $20 per play.

Fast Cash games have a progressive jackpot that can be won immediately.

With all fast cash games feeding into it, the jackpot grows with every ticket bought.

The current jackpot is indicated on each ticket, so the player would know how much they could win at that given time.

When someone wins the jackpot, another one is started. It grows again with each ticket bought.

A player can win either all of the progressive jackpot or just a part of it.

Lottery winnings: lump sum or annuity?

Players who win big on lottery tickets typically have a choice to make: lump sum or annuity?

The two payout methods can impact how much money you get from your prize.

Annuities pay out slowly in increments, often over 30 years.

Lump sums pay all at once but in a smaller amount, as taxes are withheld in one go. That means 24% of your prize goes to Uncle Sam right away. Many states tax winnings as well.

Annuities can provide winners time to set up the financial infrastructure required to take in a life-changing amount of money, but lump sums have the benefit of being taxed only once.

Inflation is also worth considering when making a choice, as payouts do not adjust with the value of a dollar. That means that you'll likely be getting less valuable money towards the end of an annuity.

Each state and game pays out prizes differently, so it’s best to check with your state’s lottery to confirm payment policies. A financial advisor can also help you weigh the pros and cons of each option.

Experts have varying opinions on whether to take the lump sum or take the annuity.

Fast Cash games may be purchased at any of the 10,500 retailers across the state of Michigan.

For any Michigan Lottery prize of greater than $5,000, authorities said they are required to withhold an estimated 24 percent in federal tax and 4.25 percent in state tax.

In this case, the prize won by the Michigan player was taxed an estimate of $122,634.

The U.S. Sun has written about other lucky winners.

A player in Massachusetts, for example, won $4 million.

Another player in Massachusetts won $1 million, and the store where they bought the winning ticket got $10,000.

Responsible gambling

Remember to gamble responsibly

A responsible gambler is someone who:

- Establishes time and monetary limits before playing

- Only gambles with money they can afford to lose

- Never chase their losses

- Doesn’t gamble if they’re upset, angry, or depressed

- National Council on Problem Gambling – https://www.ncpgambling.org/

For help with a gambling problem, call the National Gambling Helpline on 1-800-522-4700 or go to ncpgambling.org/chat