Why Investing in Stocks Isn't Like Gambling

Some people are not comfortable with investing in stocks. One of them is not a fan of gambling. He works hard for his money and doesn't like the idea of throwing it away. He believes investing is different from gambling and is better than it.

Gambling is different to investing in stocks. You can research different companies and make an informed decision based on financial data. P/E ratio is used to determine whether a stock's price accurately reflects its value. Earnings per share is basically a company's profit divided by the number of outstanding shares it has issued.

There are many factors to consider when deciding whether a stock is worth adding to your portfolio. They include: How much debt the company has, how much growth potential the business has and how innovative it is. The company's management team is also important. Publicly traded companies disclose their financial data. You can do your research and still lose money if a company starts hemorrhaging cash.

The company's debt, growth potential and innovative potential are some of the factors considered.

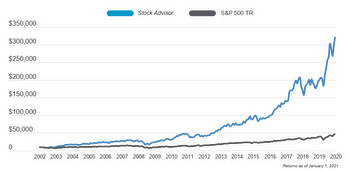

David and Tom Gardner have a stock recommendation for Walmart. They think it's not one of the ten best stocks for investors to buy right now.