Citigroup Cuts Las Vegas Sands (NYSE:LVS) Price Target to $56.00

Las Vegas Sands (NYSE:LVS - Get Rating) had its target price reduced by Citigroup from $57.00 to $56.00 in a research report issued to clients and investors on Tuesday, The Fly reports. Citigroup's price target points to a potential upside of 58.73% from the stock's current price.

A number of other equities analysts also recently issued reports on LVS. Barclays assumed coverage on Las Vegas Sands in a research report on Tuesday, June 28th. They set an "overweight" rating and a $39.00 price target on the stock. StockNews.com raised Las Vegas Sands to a "sell" rating in a research note on Tuesday, May 10th. UBS Group set a $42.00 price objective on Las Vegas Sands in a research note on Monday, June 20th. Morgan Stanley dropped their price objective on Las Vegas Sands from $44.00 to $39.00 and set an "equal weight" rating for the company in a research note on Monday, April 25th. Finally, Deutsche Bank Aktiengesellschaft dropped their price objective on Las Vegas Sands from $60.00 to $53.00 in a research note on Thursday, April 28th. Two equities research analysts have rated the stock with a sell rating, five have assigned a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $48.15.

(Ad)

Lithium may have grabbed the headlines as a key material in building electric vehicles (EVs). But so is copper. And copper's importance in the new green economy goes far beyond EVs. Copper is critical in building wind turbines and solar panels. It's key to power lines and upgrading the national grid. Analysts say we're facing a 10-million-ton shortfall if new copper mines are not found.

LVS stock opened at $35.28 on Tuesday. The stock's 50-day simple moving average is $33.78 and its 200-day simple moving average is $37.98. The company has a debt-to-equity ratio of 3.19, a quick ratio of 3.13 and a current ratio of 3.14. The firm has a market capitalization of $26.96 billion, a PE ratio of 14.64 and a beta of 1.24. Las Vegas Sands has a fifty-two week low of $28.88 and a fifty-two week high of $53.25.

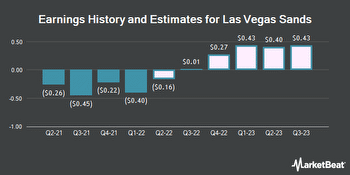

Las Vegas Sands (NYSE:LVS - Get Rating) last posted its earnings results on Wednesday, April 27th. The casino operator reported ($0.40) EPS for the quarter, missing the consensus estimate of ($0.24) by ($0.16). The company had revenue of $943.00 million for the quarter, compared to analyst estimates of $1.13 billion. Las Vegas Sands had a negative return on equity of 33.07% and a net margin of 46.40%. The firm's revenue was down 21.2% on a year-over-year basis. During the same period last year, the business earned ($0.25) earnings per share. Sell-side analysts forecast that Las Vegas Sands will post -0.68 earnings per share for the current year.

Several large investors have recently bought and sold shares of LVS. Amalgamated Bank boosted its position in Las Vegas Sands by 4.5% in the first quarter. Amalgamated Bank now owns 89,981 shares of the casino operator's stock valued at $3,498,000 after buying an additional 3,850 shares in the last quarter. Teachers Retirement System of The State of Kentucky lifted its position in shares of Las Vegas Sands by 1,072.2% during the first quarter. Teachers Retirement System of The State of Kentucky now owns 299,485 shares of the casino operator's stock worth $11,641,000 after purchasing an additional 273,935 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its position in shares of Las Vegas Sands by 30.6% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 30,717 shares of the casino operator's stock worth $1,194,000 after purchasing an additional 7,196 shares in the last quarter. Kestra Private Wealth Services LLC lifted its position in shares of Las Vegas Sands by 12.8% during the first quarter. Kestra Private Wealth Services LLC now owns 6,029 shares of the casino operator's stock worth $234,000 after purchasing an additional 685 shares in the last quarter. Finally, Toroso Investments LLC lifted its holdings in Las Vegas Sands by 5.2% in the first quarter. Toroso Investments LLC now owns 9,348 shares of the casino operator's stock valued at $363,000 after buying an additional 458 shares during the period. Institutional investors own 34.33% of the company's stock.

Las Vegas Sands Company Profile (Get Rating)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.