The house always wins, which makes casino stocks a good bet

There’s an old and irrefutable saying: “The house always wins.” It refers to the fact that casinos and online betting sites consistently make money, while gamblers almost always end up losing sooner or later.

A 2013 study by The Wall Street Journal estimated that 13.5 per cent of players that go to physical casinos come out ahead. Few of those lucky chaps had winnings of more than $150, which is the approximate price of a one-night at a two-star hotel on the strip. The study included a sample of 4,222 players. Only seven players, or slightly less than 0.2 per cent, made more than $5,000. However, 217, or nearly 5 per cent, lost more than $5,000.

In a game where the odds are against you, the longer you play, the more certain you are to lose. Based on probability theory, if one gambles long enough, their chances of winning significantly or even being slightly ahead approaches zero.

In a game where the odds favour you, the longer you play, the more certain you are to win. But – and this is important – only if your bet size, or risk, is kept acceptably low. Too much risk, even with a net positive expectation, points to disaster.

This holds true for both gaming and investing. It’s for this reason why I ended up being an income-oriented portfolio manager and not a professional gambler. Given that the house almost always wins, it seems like a good idea to consider investing in the house.

There are opportunities in both the equity and fixed-income markets to benefit from the thrill-seeking behaviour of people and their pursuit of easy money. Investors can purchase shares in casinos and online gambling sites.

The latter is a high-growth industry. According to The World Review, online gambling is growing at about 6-per-cent annually, aided by the explosion of such apps. Gamblers can play any time they want on their phones. Unfortunately, people with gambling problems now have the equivalent of an unlimited supply of any drug imaginable in their pockets.

Online betting sites, meanwhile, have become incredibly creative at giving punters the opportunity to bet on almost any imaginable occurrence. Not only can the outcome of a game be wagered on, but you can bet on which team scores next during a game.

Consider a recent N.F.L. game: The Miami Dolphins were heavy favourites over the Tennessee Titans. The Dolphins were comfortably ahead by 13 points with less than five minutes to go. The Titans proceeded to score two touchdowns and win 28-27. If someone had wagered $100 late in the quarter on the Titans, the payoff would have been in the thousands.

Algorithms and artificial intelligence allow online betting sites to instantly calculate odds and other betting opportunities in mid-play, with far more accuracy than any bookie on the planet. AI – and, specifically, machine learning – can also analyze an individual’s gambling habits to maximize how much revenue the site can earn from an individual.

For instance, online gambling sites offer players who have been quiet for a certain amount of time “free” bet credits. Of course, the rules ensure that the player must stay playing long enough to likely lose their credit and even more money. In other words, you can’t just cash out the credit. The physical casinos use the same logic when they offer an upgrade in accommodations and even flights to customers who have a habit of losing large quantities of money.

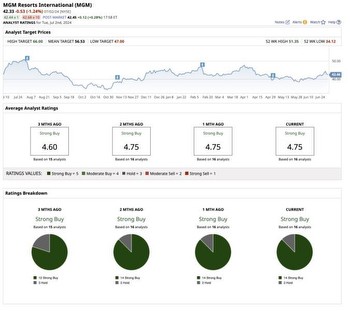

Physical casinos have been around for a while and trade on public stock markets and have high yield bonds outstanding. These companies have massive overhead costs but thankfully for them, Las Vegas and other gambling centres have recovered after the lockdowns. The larger firms include the Las Vegas Sands LVS LVS-N, MGM Resorts MGM-N, Wynn Resorts WYNN-Q and Caesars Entertainment CZR-Q. Casino firms are also getting involved in the online betting market.

The online betting industry is expected to have generated US$90-billion in revenue this year and will probably hit US$200-billion by 2035. Competition is fierce, and, as a new and growing industry, there will be a shakeout as occurred during the dot-com bubble, though less violently. A couple of companies in that space are DraftKings DKNG-Q and Fluffer Entertainment.

For investors seeking stability, casino stocks with physical properties may be the better bet. Their shares are not expensive, and there’s good upside if they manage their online growth initiatives well. As for pure-play online betting stocks, be wary. They are where internet stocks and cannabis growers were early on in their existence. Some big money will be made, but there will be a lot of folks losing their shirts.

Tom Czitron is a former portfolio manager with more than four decades of investment experience, particularly in fixed income and asset mix strategy. He is a former lead manager of Royal Bank of Canada’s main bond fund.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. .