Taxation: The right wager on online gaming

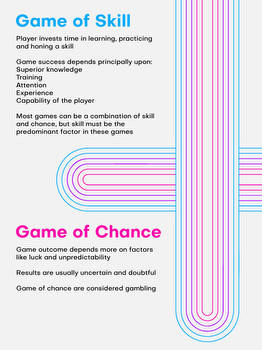

The Group of Ministers (GoM) on Casinos, Race Courses and Online Gaming will reconvene next week to discuss the rate and modality of Goods and Service Tax (GST) to be levied on these industries. Online skill gaming is a legitimate business activity and works on a platform fee model. It charges 10-20% of the total face value or wager amount.

France has a high tax rate on GGR of 37%, whereas UK has 15%. The report shows that as the tax rates increased, the channelling rate and tax revenues reduced. The move to change the base of valuation from G GR to face value or entire wager would be antithetical to the core principle of the Central GST Act. It would only lead to an increase of 900% on current taxation. Online poker industry, players and investors are waiting for the GoM meeting. They are confident of his skill and vision in continuing with the taxation framework.