States, take a chance on online gaming

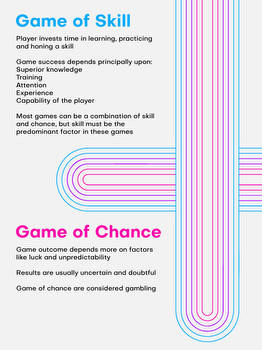

A group of ministers set up to advise the Goods and Services Tax (GST) Council on taxing casinos, race courses and online gaming is looking at whether to increase the tax rate they are subject to and the valuation of the business. The current 18% tax rate is based on the premise that online games involve skill and do not constitute gambling. And it is imposed on the gross gaming revenue, essentially on the platform service provided than on the money pooled. Voices emanating from the ministerial group reportedly suggest that the recommendation will be for a higher GST rate, but it is yet to decide whether the tax will be imposed on gross or net valuation.

India is one of the fastest-growing markets for online gaming with deep backward software and hardware linkages. Gaming has emerged as the most dynamic segment among entertainment platforms. Augmented reality (AR) is pushing user engagement as social networking shows signs of fatigue. Technology giants like Microsoft and Meta of Facebook fame are placing big bets on online gaming to propel the next phase of their growth and take on established players like Tencent and Sony.

High courts in Karnataka, Kerala and Tamil Nadu have struck down parts of laws that banned online gaming on the grounds that these did not distinguish between games of chance and games of skill. The Supreme Court is hearing a matter on skill-based online gaming that could pave the way for effective regulation, which the industry is seeking. The ministerial group may have seen merit in increasing the GST slab, having taken into consideration the Laffer curve on tax rates and revenue collections. But imposition of the tax on the entire face value of the wager could make the gaming platforms unviable, pushing them beyond Indian jurisdiction and negating regulatory requirements like knowing your customer. The panel has taken some of these concerns on board. It is examining differentiating among the activities involved in online gaming. This distinction could hold the key to an appropriate tax treatment.