Off The Record: Casino Choice In Chicago Could Have Big Effect On Des Plaines

Every once in a while, Des Plaines Ald. Malcolm Chester (6th) hoists the warning flag about the future of the city’s financial intake from the Rivers Casino operation.

For the most part it seems, his city government colleagues file his concerns in the back of their brains, leaving the matter for serious discussion for some time in the future.

Now seems like a good time for the subject to get some strong attention.

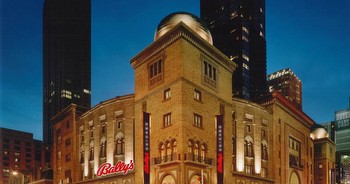

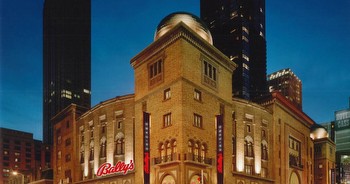

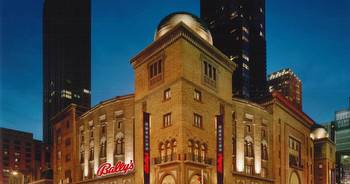

Chicago is only months away from choosing a preferred casino operator to ply its trade in the city. One of three bidders appears to have a lock on being picked.

Once the city makes its choice, the matter will advance to the Illinois Gaming Board for final approval. One of the bidders is a company controlled by real estate billionaire Neil Bluhm, who also developed Rivers Casino in Des Plaines. Rivers, since its opening in 2011, has left the state’s nine other casinos in the dust. It has consistently racked up nearly half a billion dollars a year in adjusted gross revenue. As a result, Bluhm and his partners like Churchill Downs which is now the current majority owner of Rivers, the state of Illinois and the city of Des Plaines are the main benefactors. Among the losers are nearby casinos like those in Elgin and Aurora who saw their income take a major hit when Rivers burst onto the scene.

That will probably happen once the new Chicago casino opens in a couple of years. Whatever company is awarded the license will likely open a temporary casino which will then divert the flow of huge sums of money into the big city. And, like the experiences of Aurora and Elgin, divert customers and money away from Rivers.

The deal that permitted Rivers to open in Des Plaines calls for $10 million of the city’s receipts earned by the casino to be sent to the state treasury over 30 years. Des Plaines, as host city, would end up with about $25 million per year in tax revenue. But, most of that will go to the state and 10 needy South suburbs. Des Plaines’ annual take is about $10 million. That reality has greatly benefitted Des Plaines through the funding of major street, sewer and other infrastructure projects. It has also helped the city to pay off its once high level of debt.

According to Chester, who is employed as a consultant for Potawatomi Casino in Milwaukee, WI, Des Plaines in two to three years will begin feeling the financial pinch created by the opening of a Chicago casino. Gaming money will still flow into Des Plaines, but likely not nearly as much as the amounts received during the last 10 years.

With that in mind, Chester said Des Plaines city officials will have to soon grapple with this likely reality and consider alternatives to using gaming money just for infrastructure and debt. He added, however, that there is a significant silver lining. Chester explained that once a new casino opens in South suburban Homewood, the state will start paying Des Plaines $5 million a year. Still, Des Plaines must not forget that new casinos will open relatively soon in Waukegan and in Rockford.

A Chicago casino, which Chester described will resemble operations that now glitter in Las Vegas, will involve billions – with a B – of dollars. “In two or three years down the line it is going to hurt us,” he said.