MGM Resorts is higher after Las Vegas casinos shine in Q1

MGM Resorts International (NYSE:MGM) traded higher in after-hours trading on Monday after reporting a 73% jump in revenue against a soft pandemic comparable and seeing the addition of Aria and Vdara help propel the Vegas segment to a big quarter.

Revenue from Las Vegas Strip properties was up 205% to $1.7B vs. $1.5B consensus. Adjusted property EBITDAR was of $594M vs. $108 a year ago and $577M consensus.

Las Vegas hotel occupancy averaged 78% during the quarter vs. 46% a year ago. RevPAR jumped to $154 from $60 last year.

Balance sheet update: "We reached another milestone in the completion of our asset light strategy with the closing of the VICI transaction, allowing us to simplify our corporate structure and bolster our liquidity while deploying capital into growth projects with the highest shareholder return."

MGM China was a disappointment again due to the COVID restrictions holding back traffic. An adjusted Property EBITDAR loss of $26M was recorded.

A stronger balance sheet allowed MGM to buy back $1.0B worth of stock in Q1.

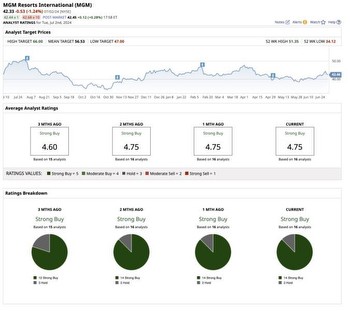

MGM) are up 1.57% in AH trading to $42.63. The conference call could include some more details on MGM's offer to buy Sweden's LeoVegas for $607M in a move that could dramatically boost its digital gaming presence in Europe.