Lottery corporation calls foul as ‘grey market’ gambling companies target B.C. market

BCLC expects windfall from single-event betting but online gambling sites from other jurisdictions will cut into revenues

Last summer’s legalization of single-event sports gambling in Canada is turning into a good news, bad news story for B.C. Lottery Corp. (BCLC).

According to its three-year service plan, published Feb. 22 with the provincial budget, the Crown gambling monopoly predicts seven per cent revenue growth in the 2022-23 fiscal year through its PlayNow branded division. However, competition from elsewhere will pose a challenge.

“While we are projecting continued growth, online gambling sites that operate illegally in B.C. (characterized as ‘grey market’) are increasing their investments in sponsorships and advertising here and across the country,” said the BCLC service plan. “As a result, it is becoming more costly for PlayNow.com to compete for advertising and sponsorship opportunities that enhance the brand’s presence and draw players to the only legal option in our province – the only one that delivers profits to fund healthcare, education and community programs.”

BCLC specifically pointed to Ontario, where that province’s regulator, the Alcohol and Gaming Commission, is licensing online gambling companies that have already taken bets illegally from British Columbians. One of those companies, BetRivers, was a heavy advertiser on CBC’s Beijing 2022 Winter Olympics coverage.

“In preparation for their legal entry into the Ontario gambling market, some operators are developing national partnerships with media companies and sports leagues, resulting in further competition and challenges for PlayNow.com when it comes to B.C.-based media and marketing partnerships,” the service plan said.

At casinos, BCLC forecasts 3,906 reports of potential crimes by the end of the current fiscal year, as per internal reporting on its iTrak database. BCLC market research found only 54% of British Columbians perceive gambling at BCLC-partnered casinos to be safe and secure.

BCLC said it had insufficient data to assess the impact of the omicron variant on casino operations, but it does forecast a 2022-23 decrease of lottery revenue by seven per cent at a time when it is replacing 3,500 lottery terminals across the province.

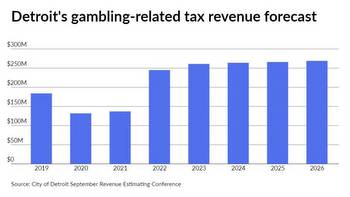

BCLC reported $430 million net income in 2020-21, but hopes to improve to $1.225 billion this year and $1.452 billion by the next.

B.C. Pavilion Corp., which operates B.C. Place Stadium and the Vancouver Convention Centre, is eager for international business travel to return, but it admits the recovery won’t begin until the second half of 2022-23. It is facing a major new competitor for corporate bookings: the computer screen.

“As a response to the pandemic, the global meetings industry has seen an increase in virtually hosted events. PavCo will need to balance the expectations of its clients to incorporate virtual, hybrid and live events; however, it is unknown how much of an influence this trend will continue to have as the sector stabilizes.”

PavCo forecasts $77.5 million in losses through 2024-25. The deficits are mainly due to B.C. Place Stadium and the debt from the 2011 renovation. The 2024-25 tally assumes $15 million in net proceeds from the potential sale of land on the east side of B.C. Place Stadium.

The province’s biggest infrastructure project cost $8.4 billion through Dec. 31.

BC Hydro’s three-year plan said Site C would cost a further $7.64 billion to complete by the end of 2024.

On Feb. 26, 2021, the BC NDP government admitted the dam would cost $16 billion and take longer to build. In 2014, the BC Liberal government set a $8.775 billion budget. The NDP blamed cost overruns on pandemic slowdowns and geotechnical challenges.

The BC Hydro report estimates $2.52 billion will be spent in the fiscal year beginning April 1, $2.56 billion in 2023-24 and $1.13 billion in 2024-25.

Auto insurer ICBC is forecasting $1.9 billion in net income by the end of March, substantially higher than the $154 million forecast and an improvement on the $1.54 billion for the previous year.

“The forecasted net income for 2021/22 is $1.75 billion favourable to plan, mainly as a result of higher investment income and lower claims costs; in addition to a lesser extent higher premium revenue and lower operating expenses also contributed to the favourable net income,” said ICBC’s service plan.

The Liquor Distribution Branch is expecting $1.15 billion net income for this fiscal year and $1.66 billion for the next.

The number of private retail cannabis stores supplied by LDB’s wholesale division grew by 101 during this fiscal year. As of last Nov. 24, the province had licensed 384 stores and 370 of them had registered and placed orders for non-medical pot.