IRS embraces higher handpay limits for casinos and cruises

Generally, any interaction with the Internal Revenue Service means something bad has happened.

The agency never sends you a letter saying “thanks for paying your taxes,” and it rarely has an IRS agent check in on a business owner to see how his vacation was.

More often, when an IRS letter shows up in your mailbox, it’s a heart-stopping moment. At its best, dealing with the agency is a hassle. Filing your taxes takes some effort and the IRS has endless power to question your deductions, income and anything else.

Casino gamblers, however, have a special beef with the IRS. Gambling wins are treated as income. As a practical matter, however, most people do not track their small wins and losses.

Players who use loyalty cards to track their play can get a win/loss statement at year’s end and they can deduct their losses from any wins.

The biggest complaint, however, comes as a result of what gamblers call a hand pay, a win of $1,200 or more on a slot machine.

What happens with a casino hand pay?

When that happens, the machine you are playing freezes and you have to wait for an attendant. That can often take a long time as casinos — whether you’re on the Las Vegas Strip, in a regional casino, or on a cruise ship that sails from a U.S. port — don’t seem to have personnel scouring the floor for the light that goes on.

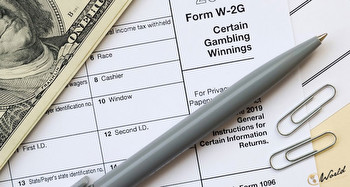

It’s a frustrating process: You have to sit at your machine to wait for an attendant who collects your driver’s license and then brings you a W-2G, the IRS form that tells the agency about your win and forces you to report the winnings.

If you’re lucky enough to hit multiple hand pays on the same day (or on the same cruise), the process happens a little faster the second time, but the process makes scoring a big win frustrating.

Many casino gamblers, both on land and at sea, complain about the process specifically because the $1,200 limit has been in place since 1977. That’s 46 years with no increases, which puts that number well out of whack with inflation.

IRS moves closer to raising tax form limit

Casinos don’t like this rule because they have to devote labor to completing the forms. Players don’t like it because they have to stay at their machines but can’t play, hoping to get the attention of a casino worker,

All land-based casinos follow the rules, while nearly every cruise line sailing from U.S. ports does. MSC Cruises, a growing rival to Royal Caribbean and Carnival, does not opt into the program. In theory, any casino wins on an MSC ship are still taxable, but in practice it seems unlikely that anyone would report their winnings without a W2G being filed.

The IRS Advisory Council, however, has recommended that the W2G threshold increase to $5,800. IRS Commissioner Danny Werfel appeared to back such a move during a recent appearance in Congress.

“I think it’s very valuable when we get input from the taxpaying community and our Advisory Council on when thresholds may be out of date,” Werfel said, according to Casino.org. “The determination of something like that is of regulatory nature and therefore the decision rests with the Treasury’s Office.”

The change has been championed by U.S. Reps. Dina Titus (D-Nevada) and Guy Reschenthaler (R-Pennsylvania). They note that the purchasing power of $1,200 today equals $6.200.

“Because the threshold has not kept up with inflation, it has resulted in a drastic increase in reportable jackpots, which trigger tax burdens for winners and compliance burdens for casinos,” explained Reschenthaler.

“Increasing the threshold will eliminate this onerous red tape, ensuring the gaming industry can continue to support good-paying jobs, and foster economic growth in Pennsylvania and across the country.”