Still No Action from the IRS and Treasury on Slot Jackpot Limit

The slot jackpot threshold for reporting to the IRS was established back in 1977. The gaming industry has urged for changes of the threshold, but the Treasury has not taken any action.

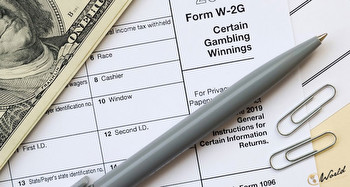

The $1,200 slot jackpot threshold for reporting a slot machine win to the IRS hasn't been reviewed since 1977. The casino industry continues to expand in the United States. It is mandatory for the operator to issue a W-2G form and to report the win.

There is still no action from the IRS and Treasury on Slot Jackpot Limit. Representative Dina Titus and Darin LaHood want the Treasury to raise the threshold for reporting of slot winnings. Senator Catherine Cortez Masto supports the efforts of Representative Titus.

The slot machine locks up when a player hits the jackpot above the $1,200 threshold.

There is still no action from the IRS and Treasury on the Slot Jackpot Limit. Global Market Advisors and AGA support the increase of the slot jackpot threshold. AGA also urged government officials to update the outdated jackpots reporting threshold to $5,000. The increase would let the Treasury free up resources and reduce the communication between patrons and casino employees.